Travel rule overview (Reform)

If you’re a reporting entity that transfers or receives money, virtual assets or property on behalf of your customers, you may need to collect, verify and share specific information with other businesses in the transfer. This is known as the travel rule.

On this page

- Overview of the travel rule

- When the travel rule applies

- Key terms related to the travel rule

- Roles in a value transfer chain

- Information required in a transfer message

- Missing or inaccurate information

- Transition to new global travel rule standards

- Travel rule policies

- Record keeping

- Related pages

This guidance will help you determine if the travel rule applies to your business and explains the steps you must take to meet your obligations.

Overview of the travel rule

This section refers to the Act sections 65(2)(a) and 66(2).

The travel rule typically applies to:

- financial institutions

- remittance service providers

- virtual asset service providers

- some other international transfers of value, such as transfers by gambling service providers or currency exchange businesses where the transfer of value is incidental to another service.

If you accept an instruction to transfer value, you’ll have obligations. These obligations will depend on the type of transfer, and in some cases include collecting and verifying information about the payer and collecting the payee’s full name.

You must do this before passing on a transfer message or otherwise giving effect to the transfer of value. You may also need to pass on information about any accounts or virtual asset wallets relevant to the transfer to other businesses involved in the transfer.

A business that receives transfer messages must take reasonable steps to monitor that it has received the required information and, in some circumstances, whether the information is accurate.

The purpose of the travel rule is to make sure that the parties involved in domestic and international value transfers are transparent to the businesses giving effect to the transfers. This allows businesses to manage their money laundering, terrorism financing and proliferation financing risk (we refer to these as your ML/TF risks) more effectively.

It also makes sure that information is available to law enforcement and other authorities upon request.

Every time you accept an instruction from the payer to transfer value, a new value transfer chain begins with its own travel rule obligations. For example, if a customer receives value into their account or custodial wallet and the customer then instructs you to transfer that value to a separate account or custodial wallet this is a new value transfer chain. There will be travel rule obligations associated with both transfers.

When the travel rule applies

This section refers to the Act section 5 (definition of transfer of value).

The travel rule doesn’t apply to transactions that solely involve the transfer of physical currency or other tangible property. For example, if your business is physically transporting banknotes or gold bullion the travel rule won’t apply. Similarly, transferring ownership of real estate will not trigger travel rule obligations.

The travel rule may apply if you:

- accept money, property or virtual assets from a payer to transfer to a payee

- transfer funds from a payer’s account or receive funds into a payee’s account

- draw the funds to be transferred from the payer’s account with another business, or deposit transferred funds into the payee’s account with another business

- transfer virtual assets, such as cryptocurrency, from a payer’s account or custodial wallet or receive virtual assets into a payee’s account or custodial wallet

- carry out the economic equivalent of a transfer of value by arranging for offsetting payments from the payer or to the payee (which can involve third parties)

- transfer value associated with owning property from a payer to a payee. For example, transferring the value of bullion but not transferring the physical bullion itself.

The sections on this page will help you determine if the travel rule applies when you provide any of your designated services.

Key terms related to the travel rule

This section refers to the Act sections 5, 64(2), 64(5) and 66(5) and the Rules sections 1–8, 8–3 and 8–5.

The following terms are important for understanding the travel rule.

Transfer of value

A transfer of value means a transfer of money, virtual assets or property. It doesn’t include:

- the transfer of physical currency or tangible property

- the transfer of securities or derivatives, unless these are also virtual assets

- transfers as part of some payroll and superannuation services.

Value transfer chain

The value transfer chain refers to the businesses involved in a transfer of value. It includes:

- the ordering institution

- any intermediary institutions

- the beneficiary institution.

Transfer message

A transfer message is a message that includes information about the payer’s instructions for the value transfer. It includes details about the transfer, such as who are the payer and payee.

An institution involved in a transfer of value will send a transfer message to the next institution in the value transfer chain.

The information required in a transfer message depends on the circumstances of the transaction.

Learn more about the Information required in a transfer message.

Offsetting arrangements

An offsetting arrangement is a way to transfer value without moving that value directly from the payer to the payee. A financial credit and debit (offsetting) relationship between an ordering and beneficiary institution can allow the 2 businesses to complete a transfer for a payer and payee. These 2 businesses can then reconcile the value of the released funds at a later date.

This can involve a series or combination of transfers, sometimes including third parties, to complete the intended transfer of value.

In some cases, the ordering institution or beneficiary institution may never have custody or control of the value.

Requests for information

You may receive a request for information from other institutions in a value transfer chain. The information that may be requested includes the:

- payer information

- payee's full name

- tracing information

- card information (if applicable).

You’ll only need to provide information you're required to collect or pass on for the relevant transfer. For example, if you're an ordering institution and receive a request for a record about a merchant payment, then you would need to provide information about the card number used for that payment.

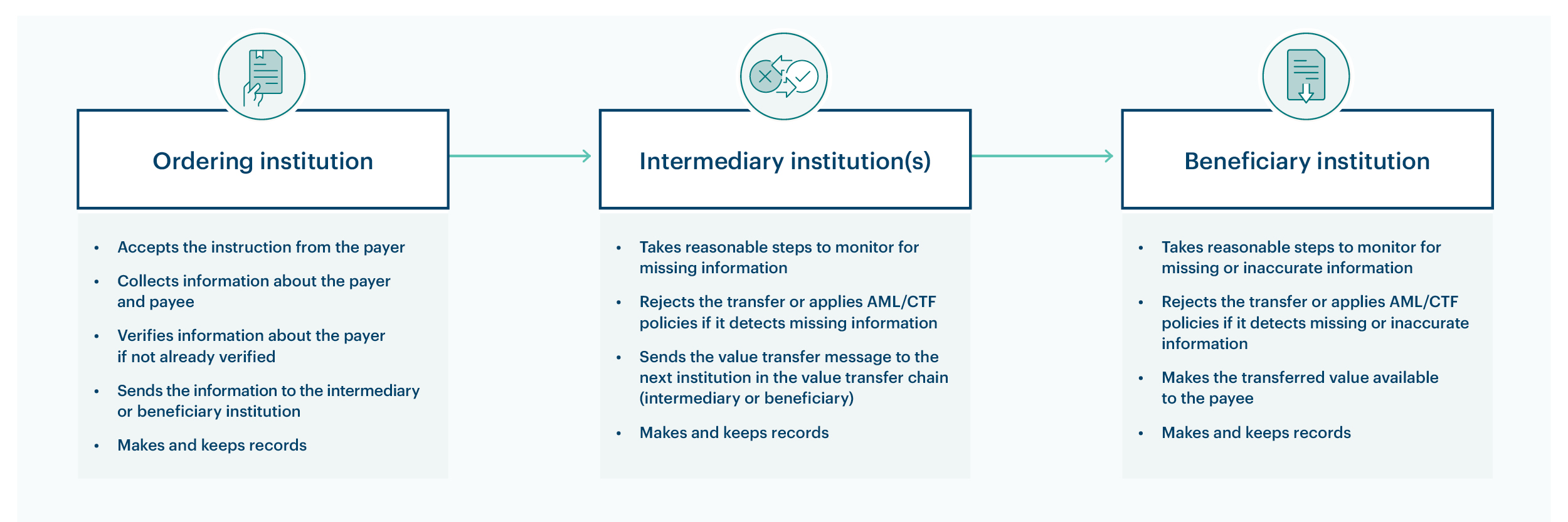

Roles in a value transfer chain

This section refers to the Act sections 63A and 6, table 1, item 31 and the Rules sections 8–1 and 8–2.

This section explains the role of an ordering institution, an intermediary institution and a beneficiary institution in a value transfer chain.

Overview of the role of each institution

Ordering institution

An ordering institution accepts the instruction to transfer value from its customer, the payer. The payer can be the same person as the payee.

There can only be one ordering institution in a transfer of value. The ordering institution may be the same as the beneficiary institution if the same institution accepts the instruction and makes the value available. If more than one institution is involved in the transfer of value, the ordering institution passes on a transfer message to the next business in the value transfer chain.

Examples of where you may be an ordering institution include where you:

- receive the value to be transferred directly from the payer or another person acting on their behalf

- hold this value to be transferred in an account provided to the payer or on deposit from the payer, including in a custodial virtual asset wallet

- are authorised by the payer to transfer value from a third-party deposit taker or credit provider

- transfer value for a payer by using an offsetting arrangement with the beneficiary institution.

You’re not an ordering institution if a transfer of value is reasonably incidental to providing another service. This is the case unless the transfer of value is either:

- domestic or an international value transfer service and you’re a financial institution

- an international value transfer service and you’re a gambling service provider providing gambling services

- an international value transfer service and you’re a currency exchange business providing currency exchange services

- an international value transfer service and you’re a virtual asset service provider (VASP) providing virtual asset exchange services.

Note that if you're a VASP, all non‑incidental transfers of virtual assets will be subject to the travel rule whether domestic or international.

For example, if your customer instructs you to transfer virtual assets to another wallet the travel rule will apply. Regardless of whether the transfer is domestic or international.

Learn more about incidental transfers of value when providing another service.

Intermediary institution

An intermediary institution receives and passes on transfer messages but doesn’t accept the instruction from the payer or provide the payee with the transferred value. There can be zero or multiple intermediary institutions as part of a transfer of value.

You’re an intermediary institution if you receive a transfer message and pass on the transfer message to the next business involved in the value transfer chain. A value transfer chain starts with an ordering institution and ends with a beneficiary institution. Intermediary institutions are a ‘link’ in the chain between an ordering institution and a beneficiary institution and can’t exist outside a value transfer chain.

You’re not an intermediary institution if you only provide the infrastructure used to pass on the transfer message. For example, the Society for Worldwide Interbank Financial Telecommunications (SWIFT) messaging system used by financial institutions for international payments.

Beneficiary institution

A beneficiary institution receives the transfer message and makes the transferred value available to the payee. The payee may be the same person as the payer.

There can only be one beneficiary institution in a value transfer. The beneficiary institution may be the same as the ordering institution if the same institution accepts the instruction and makes the value available.

Examples of where you may be the beneficiary institution include where you:

- make the transferred value directly available to the payee or another person acting on their behalf

- deposit the transferred value into an account held by the payee with the beneficiary institution (including in a custodial virtual asset wallet) or hold the value on deposit

- have an arrangement with the payee by which you deposit the transferred value with another business. For example, depositing the transferred value into an account that the payee holds with another business

- make transferred value available to a payee using an offsetting arrangement with the ordering institution.

You’re not a beneficiary institution if a transfer of value is only incidental to providing another service. This is the case unless the transfer of value is either:

- domestic or an international value transfer service and you’re a financial institution

- an international value transfer service and you’re a gambling service provider providing gambling services

- an international value transfer service and you’re a currency exchange business providing currency or virtual asset exchange services

- an international value transfer service and you’re a VASP virtual asset exchange services.

Note that if you are a VASP, all transfers of virtual assets that aren't incidental to another service will be subject to the travel rule whether domestic or international. For example, if your customer receives virtual assets into a custodial wallet that you provide the travel rule will apply, regardless of whether the transfer is domestic or international.

Information required in a transfer message

This section refers to the Rules sections 8-3 and 8-5.

When completing a transfer of value, you’ll send a transfer message. The details you’re required to pass on depend on the circumstances of the transfer, but typically include:

- payer information

- the payee’s full name

- tracing information.

Payer information

A transfer message must include information about the payer except when completing:

- domestic transfers of money using the Bulk Electronic Clearing System (BECS), BPAY or Direct Electronic Funds Transfer (DEFT)

- merchant payments

- refunding merchant payments (all other ‘push payments’ effected using credit, debit or stored-value cards must include payer information, the payee’s full name and tracing information)

- a withdrawal of money using an ATM.

The information that must be included in a transfer message will sometimes be different from the information that an ordering institution is required to collect. Learn more about what payer information the ordering institution must collect in travel rule obligations for ordering institutions.

Payee’s full name

A transfer message must include the payee’s full name except when completing:

- domestic transfers of money using BECS, BPAY or DEFT

- some merchant payments

- refunding merchant payments

- a withdrawal of money using an ATM.

Tracing information

The transfer type determines the tracing information you must provide. The type of tracing information that’s required must satisfy certain criteria for both the ordering and beneficiary institutions.

Learn more about:

- travel rule obligations for ordering institutions

- travel rule obligations for beneficiary institutions

- travel rule obligations for intermediary institutions.

Card numbers

A transfer that involves a merchant payment, refunding a merchant payment or a transfer of money using an ATM must include the card number in the transfer message. A card number includes a tokenised reference that allows the card issuer to trace the payment to the payer’s card.

Missing or inaccurate information

This section refers to the Act sections 65(2) and 66.

Intermediary and beneficiary institutions must take reasonable steps to monitor for missing information in a transfer message. Beneficiary institutions must also take reasonable steps to monitor for an inaccurate payee full name in a transfer message.

You don’t need to manually monitor each individual transfer message in all cases. Your anti-money laundering and counter-terrorism financing (AML/CTF) policies for monitoring transfer messages must appropriately mitigate and manage the ML/TF risk you face when providing transfer of value services. AML/CTF policies must also be appropriate to the nature, size and complexity of your business.

You’ll define your risk-based approach in your AML/CTF policies. Your approach to appropriately mitigate and manage your risk should consider the ML/TF risks you face in providing transfer of value services, and include consideration of your:

- business

- risk profile

- exposure to ML/TF risk.

For example, you may determine that you’ll monitor for missing or inaccurate information by sampling transfer messages and completing other assurance activities. You may also use your AML/CTF policies related to transaction monitoring as part of your reasonable steps to monitor for the purpose of the travel rule.

Transition to new global travel rule standards

This section refers to the Rules section 8–6.

In June 2025, the Financial Action Task Force updated recommendation 16 to:

- remove any expectation that verified place of birth information would be included with transfer messages

- require more information about the payer and payee to be passed on with transfer messages.

Global transition to the requirements of the revised recommendation 16 is expected to take some years. The cross‑border nature of travel rule requirements means that for many sectors the standardised transfer message formats, such as ISO20022, will need to be amended. For the financial sector, the FATF envisages this occurring in 2030.

Some reporting entities, such as remitters and VASPs, may use more contained payment ecosystems or bilateral arrangements. These entities may wish to build new systems to the new standard. By permitting the implementation of revised global standards, the AML/CTF Rules allow institutions to operate at different speeds when implementing the updated messaging format. This will benefit institutions, because they won’t be required to treat incoming messages in the new format as lacking required travel rule information.

You may therefore choose to use ‘payer information’ and the payee’s full name in fulfilling your travel rule obligations. Alternatively, you may use the following information instead of ‘payer information’:

- the payer’s full name

- the payer’s full business or residential address (excluding a post office box)

- if the payer is an individual, their date of birth

- if the payer is a body corporate, a unique identifier (if applicable).

If you're an ordering institution, you must still verify this information either through initial CDD when onboarding the payer, or specifically for the purposes of the travel rule, before passing on a transfer message or otherwise giving effect to the transfer.

If you're relying on the revised requirements, you must use following information in addition to the payee’s full name:

- if the payee is an individual, the town and country they live in

- if the payee is a body corporate, the town and country it operates in, along with a unique identifier (if applicable).

You can’t use the old standard for one element of the travel rule information and the revised standard for another. If you choose to use the alternative travel rule information about the payer, you must also use the revised travel rule information about the payee.

Travel rule policies

This section refers to the Act sections 26F(1), 116(3) and 107 and the Rules sections 5–17 and 5–19.

You must have AML/CTF policies that describe how you’ll:

- collect and verify information as an ordering institution

- monitor that you’ve received all required information as an intermediary institution or beneficiary institution

- monitor for inaccurate information about the payee as a beneficiary institution

- make decisions whether to pass on a transfer message, make the value available to the payee and any other measures to manage and mitigate ML/TF risk.

You must also have systems, procedures and controls that will support you with meeting your travel rule obligations. This includes having policies, procedures, systems and controls that:

- describe how you’ll meet your obligations when responding to a request for information

- help you meet your obligations when responding to a request for information.

These policies, procedures, systems and controls must appropriately mitigate and manage the ML/TF risk you reasonably face in providing value transfer services.

Learn more about developing and maintaining your AML/CTF policies.

Record keeping

You must make records of individual transactions related to the value transfer services you provide. You must keep these records for 7 years. These records must contain sufficient information to reconstruct the transaction. This may include:

- payer information

- payee’s full name

- tracing information

- card information (if applicable).

You must keep records of your AML/CTF policies for 7 years from the date they’re last used. For example, if you update a policy on 15 April 2023, you must keep the original policy until 14 April 2030.

You must also keep records that demonstrate that you’ve met your travel rule obligations, including complying with your AML/CTF policies, and keep these records for 7 years.

Related pages

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.