Understanding reporting groups (Reform)

Reporting groups replace designated business groups. Learn how they function and how you can form one.

On this page

This section refers to the Act section 10A(1)(a–b).

A reporting group is a group of persons that includes one or more reporting entities. Reporting groups have a lead entity and ordinary members (members).

If you want to form a reporting group, you can do so if either:

- your business is controlled by or controls another business and each member in the group agrees on a lead entity (reporting groups that are business groups)

- you elect to join a group (elective reporting groups).

Reasons to form a reporting group

This section refers to the Act sections 26F(5) and (6), and 236B(5).

Reporting groups allow groups of reporting entities to share and centralise AML/CTF functions. This means that you can:

- share resources

- reduce costs

- identify, assess, manage and mitigate money laundering, terrorism financing and proliferation financing risks (we refer to these as ML/TF risks) more effectively.

Group-wide AML/CTF policies support the effective and secure sharing between members of your reporting group of:

- ML/TF risk-related information

- AML/CTF compliance-related information.

This reduces the risk that information sharing will contravene the tipping off offence when members share information related to suspicious matter reports.

Reporting groups can also include businesses that aren't reporting entities. These businesses aren't subject to AML/CTF obligations or AUSTRAC supervision. They can assist reporting entities in the group by carrying out AML/CTF obligations on their behalf.

Reporting groups replace designated business groups

This section refers to the Act section 236B(5).

Reporting groups replace designated business groups (DBG) under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (the Act) from 31 March 2026.

If you’re a designated business group (DBG) you’ll need to decide if you’ll form a reporting group. If you do form one with your existing members, we expect by 31 March 2026, that you make sure:

- your reporting group includes all members of the current DBG

- each member agrees in writing on the lead entity (for business groups)

- each member elects to form the group and agrees on a lead entity in writing (for elective reporting groups)

- your group-wide anti-money laundering and counter-terrorism financing (AML/CTF) program meets the new requirements.

If you’re a member of a current DBG, and decide not to become a member of a reporting group, you’ll both:

- need to develop your own, separate program

- not be able to rely on the joint program made under your former DBG from 31 March 2026.

If you don’t do this, you could fail to meet the requirements under the Act, which may attract civil penalties.

Learn more about the consequences of not complying.

You must also tell us if you’re in a reporting group by updating your enrolment details. Learn more about enrolment.

Some of the benefits reporting groups provide over DBGs are:

- a more flexible framework for members

- they can now include non-reporting entities as members

- members of reporting groups can discharge AML/CTF obligations on behalf of other members.

This means your members can operate under a group-wide AML/CTF program. This can help to manage and mitigate ML/TF risks through group-wide:

- common AML/CTF policies

- risk management frameworks

- oversight mechanisms.

However, these arrangements may not be identical across all members. Especially in large or diverse reporting groups.

Reporting groups that are business groups

This section refers to the Act sections 10A(1)(a) and (3)(a).

Your business group will form a reporting group if all the following are satisfied:

- a control relationship exists

- at least one person in the group provides a designated service

- each member agrees in writing on who the lead entity is.

The members of your business group will be all the persons within the control structure, even if they're offshore and have no link to Australia. For help on determining this, see ownership and control.

Business groups might form in structures, such as:

- parent/subsidiary arrangements

- trust-managed structures

- vertically integrated structures

- other business arrangements between persons involving control by one person over the other (or others).

Learn more about forming a reporting group with your business.

Elective reporting groups

This section refers to the Act section 10A(1)(b) and the Rules section 2-2.

These are groups formed by agreement between businesses. This is useful where there’s any of the following:

- no control structure involved with any of the businesses (businesses within these control structures can only join a reporting group collectively)

- sharing of operational processes, services or branding, such as in some franchise arrangements

- a desire to centralise or streamline group risk and compliance management.

Elective reporting groups may benefit some business arrangements where there’s no control relationship. For example:

- franchises

- agency or distribution networks involving more than one business

- businesses that share their service models with other businesses

- joint ventures.

You may also elect to include an entire business group into your elective reporting group framework. However, if you do so, the entire business group must join. You can’t just elect some of these members.

Learn more about forming an elective reporting group.

How reporting groups function

This section refers to the Act sections 10A(5) and 236B(6), the Rules sections 2–1(1) and 2–2(3) and Explanatory Memorandums 46, 51 and 53.

You must have a lead entity if you’re a reporting group. In addition to the legal obligations on individual reporting entities, your lead entity is legally accountable for the following:

- developing a group-wide ML/TF risk assessment and AML/CTF policies

- implementing group-wide AML/CTF policies

- ML/TF risk management

- AML/CTF compliance management.

As a member you’re also legally accountable and must meet your AML/CTF obligations as a member of a reporting group.

Determining the lead entity in a reporting group depends on if the reporting group is either:

- a business group

- an elective reporting group.

Forming a reporting group enables lead entities to delegate obligations to members on behalf of the other members. For example:

- reporting obligations

- elements of the group-wide policies that have been assigned to them

- customer due diligence (CDD).

In some cases, you might choose one member to discharge obligations on behalf of other members. This might be useful for more complex business structures that deliver a range of designated services.

However, if you’re a lead entity, you are accountable for each member’s AML/CTF program.

Learn more about liability for breaches.

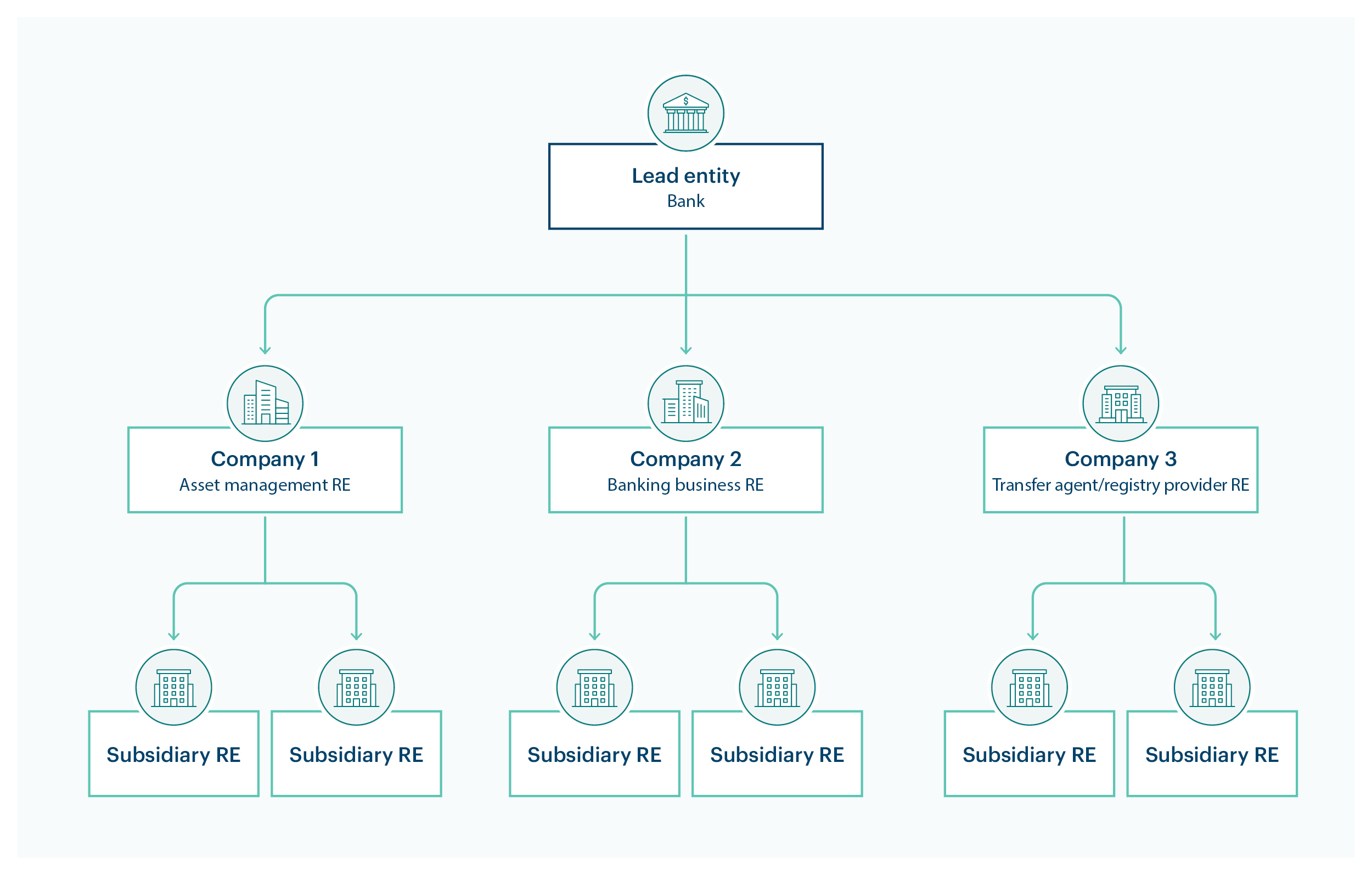

Example: lead entity (parent company) delegates AML/CTF program development to subsidiaries

- Companies 1, 2 and 3 discharge the obligation to develop programs for their respective subsidiaries. Each of these companies and their subsidiaries specialise in the same designated service.

- Companies 1, 2 and 3 develop separate programs for themselves and their respective subsidiaries.

- These programs are specific to the AML/CTF obligations and ML/TF risks of each of the 3 designated services.

- The lead entity is accountable for each member’s program.

Members and ML/TF risk

This section refers to the Act section 26F(6)(c).

Reporting groups also allow group members to share ML/TF risk-related information within the reporting group. For example, CDD information, where it’s appropriate to manage risk and compliance.

Members and designated services

This section refers to the Act section 6(6A).

Services provided between members of business groups aren’t designated services. These services aren’t subject to AML/CTF regulation because members provide them to each other within the group.

This also applies if business group members both:

- join an elective reporting group

- provide designated services to members of the elective reporting group who are business group members.

However, services offered by business group members to any elective group members are still designated services, as are services offered between elective group members who aren't in the same business group.

For example, all 3 members of a business group join an elective group consisting of 2 separate businesses. Services provided between the 3 members of the business group aren’t designated services. The services provided between the business group members and the elective group members can be designated services.

Members of elective groups may leave these groups at any time by giving notice.

Information on enrolment

This section refers to the Act section 51F and the Rules sections 3–3(8) and 3–9.

You must enrol with us if you’re a member of a reporting group and are either a:

- reporting entity

- lead entity.

Your application must state whether you’re:

- a member of a reporting group

- the lead entity of a reporting group.

If you’re a lead entity, your application must include information about the members that are reporting entities. This includes:

- the name of each reporting entity

- any identifier we may have given to the reporting entity

- another unique identifier the reporting entity has, for example ABN or ACN.

If you’re a member of a reporting group and not the lead entity, your application must include:

- the name of the lead entity

- any identifier we may have given

- another unique identifier for the lead entity, for example ABN or ACN.

You must update us of any changes to these enrolment details within 14 days of the change occurring.

Members who aren’t reporting entities

If you’re a member of a reporting group that’s a business group and you stop providing designated services:

- we expect you to apply for removal from the Reporting Entities Roll

- you’ll remain a member of the business group.

Learn more about how to request removal from AUSTRAC roll or registers.

Related pages

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.