Forming reporting groups (Reform)

There are 2 ways you can form a reporting group. Learn how they form through control or election.

On this page

- Forming a reporting group with your business group

- Forming elective reporting groups

- The role of lead entity

- Related pages

Forming a reporting group with your business group

This section refers to the Act sections 10A(1)(a) and (3) and 11 the Rules section 2–1(2)(a-c).

Control is the main principle to the formation of business groups. To determine if you’re a business group, you must consider if you’re within a control structure. This is where your business controls or is under the control of another person.

You won’t be in a business group unless a control relationship exists.

Learn more about determining control.

A business group forms when all the following apply:

- one person controls one or more persons

- at least one of the persons provides a designated service.

The members of the business group will then be all persons within the control structure.

Your business group can only form a reporting group if each member of your business group agrees in writing on a lead entity.

Example: Your business provides designated services and is a subsidiary of a parent company (which doesn’t provide designated services). The parent company also controls other persons. Your business and the parent company are in a business group, along with the other persons the parent company controls.

To form a reporting group, each member in the control structure must agree in writing on a lead entity. This includes any member that:

- is a reporting entity

- isn’t a reporting entity

- will be the lead entity.

Your lead entity must be able to decide the outcome of decisions about anti-money laundering and counter-terrorism financing (AML/CTF) policies of all members of the group.

You can’t form a reporting group with only some of the members of the business group. All must be included in the reporting group. If all members of the business group can’t agree on who will be the lead entity, your reporting group won’t form.

Learn about the role of lead entities.

If you’re a member of a business group and you stop providing designated services, you’re both:

- no longer a reporting entity

- still in the business group and remain a member of this group.

You should apply for removal from the Reporting Entities Roll.

Learn how to request removal from AUSTRAC roll or registers.

Determining if you’re in a business group

This section refers to the Rules section 2–1(1) and (2)(a) and Explanatory Statement 62.

Your first step is to determine if you’re in a business group, which requires you to determine the control structure of the businesses in your group.

To determine your control structure and members, start by asking is:

- your business part of a wider business group structure, where one or more persons are controlled by another person?

- a designated service provided by any person within this business group?

If you answered ‘yes’ to all of these, you might in a business group. Your group will include the following persons as members:

- your business

- the person who controls the other persons in the group

- all the persons who this person controls.

Once you’ve identified your control structure and members, your group members must then agree on a lead entity in writing to form a reporting group.

Learn more about the role of the lead entity and determining control.

Forming elective reporting groups

This section refers to the Act section 10A(1)(b).

An elective reporting group can form when 2 or more reporting entities agree to do so. A business group can also join an elective reporting group, but all members of the business group must join.

Election process and eligibility

This section refers to the Act sections 10A(1)(b)(i and iii) and the Rules sections 2–2(1)(a–c), (3)(b), (4), (5), (7), (8), (9) and (10)(a).

To form an elective reporting group each of your members must both:

- elect in writing to be a member of the group

- not be a member of another elective group.

Members in your elective reporting group must be one or more of the following:

- a reporting entity

- a person who discharges AML/CTF obligations on behalf of another member

- all of the members of a business group.

Once formed, all members in your elective reporting group (including the member being elected as lead entity) must:

- agree on a lead entity

- make sure that your group doesn’t operate without a lead entity for more than 28 days.

Learn more about the role of lead entity.

When you join or leave an elective reporting group there are requirements you must meet. This includes:

- getting the lead entity’s consent to join an existing elective reporting group

- providing written notice to the lead entity when you leave the group

- if you’re the lead entity, providing written notice to your members when you leave.

If you are in a business group that is in an elective reporting group, then the whole business group must join or leave together.

Business group members joining an elective reporting group

This section refers to the Rules sections 2–2(1)(c), (2), (5–6), (9) and (11).

This may be useful to larger businesses who share operations with entities outside of their control structure.

You can elect to join or leave an elective reporting group if you are a member of a business group. However, all the members of your business group must also join or leave with you.

For example, if you join an elective reporting group and are a member of a business group, all persons in your business group must join with you. If you leave the elective group, then all members of your business group must leave with you.

You can join an elective reporting group if both:

- another member of your business group elects to join on behalf of all members

- each member of your business group agrees to join.

We’ll consider you as a member of the elective reporting group only if you’re a member of both:

- an elective group

- a business group

The role of lead entity

This section refers to the Act sections 26F(5–6) and 10A(5), the Rules sections 2–1(2)(b–d) and 2–2(3)(a)(c–d) and Explanatory Memorandums 46, 51, 53 and 56.

Your reporting group must have a lead entity.

Your lead entity is the person responsible for group-wide AML/CTF compliance. This includes:

- ensuring the appropriate sharing of information between members

- the creation and maintenance of the group-wide AML/CTF policies and ML/TF risk assessment

- oversight and management of members’ AML/CTF compliance

- management of ML/TF risks.

Your lead entity acts as the central point of accountability for your reporting group’s compliance under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (the Act). If you’re a member that’s a reporting entity, you’re also directly accountable for compliance with the Act for the designated services you provide.

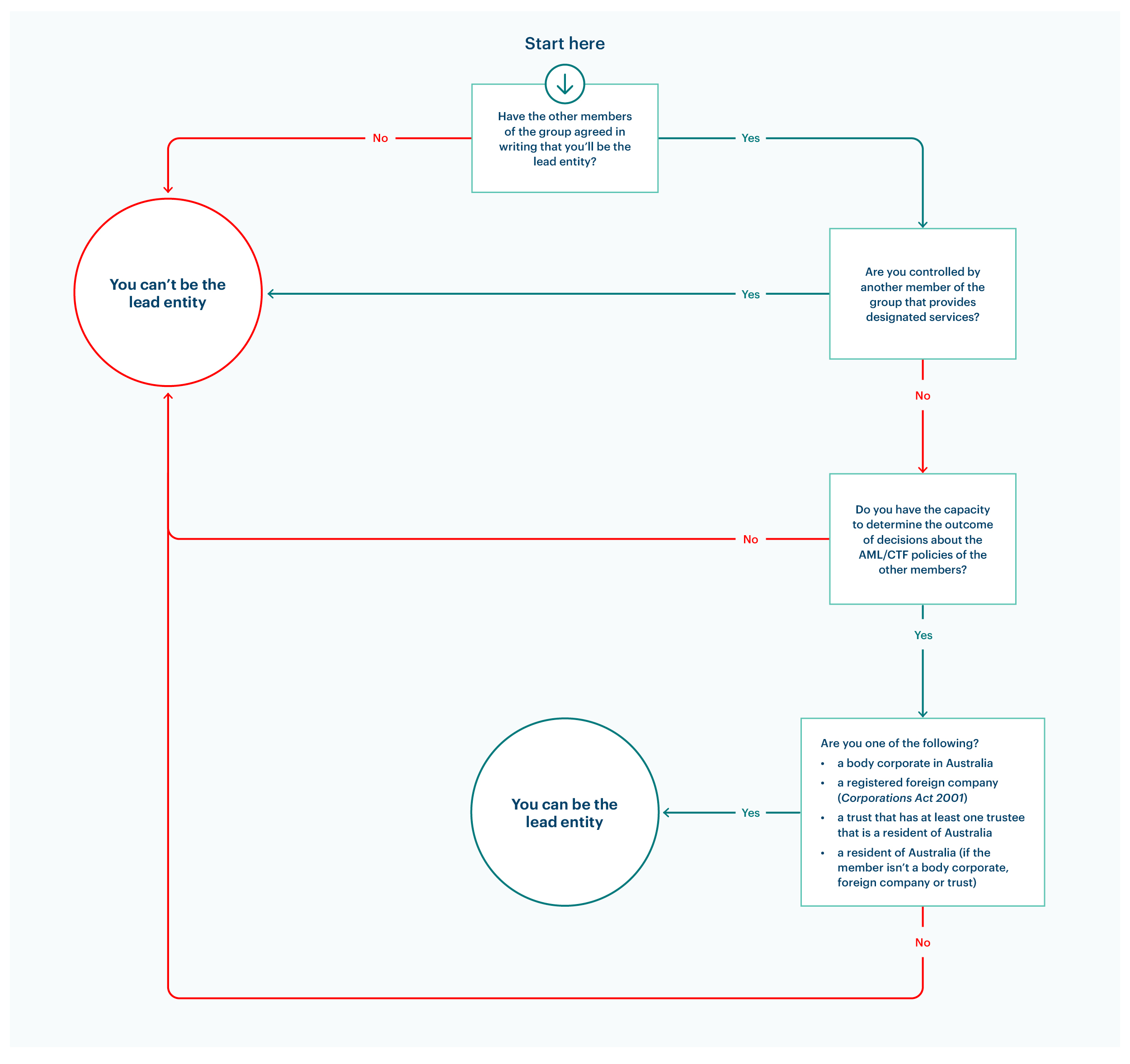

Whilst lead entities of business and elective reporting groups differ, they share common requirements. The lead entities must both:

- not be controlled by another member that provides a designated service

- have the capacity to determine the outcome of decisions about the policies of other members.

Both business group and elective reporting group lead entities must be an Australian-based member, meaning they’re one of the following:

- an Australian resident

- a body corporate incorporated in Australia

- a registered foreign company (within the meaning of the Corporations Act 2001)

- a trust that has at least one trustee that’s a resident of Australia.

Reporting groups that are business groups

This section refers to the Rules sections 2–1(1), (2)(a) and (d).

Your business group can only form a reporting group if all the members agree to a lead entity in writing. This includes the member who will be the lead entity.

If any member disagrees, then the business group can’t form a reporting group.

Members of the business group will still be able to join or leave an elective reporting group. To do so, all members of the business group must agree to join and leave together.

The flowchart below will help you determine who can be a lead entity of your business group for the purposes of forming a reporting group. If your answers lead you to ‘you can’t be the lead entity’, we recommend restarting the process.

Can I be a lead entity?

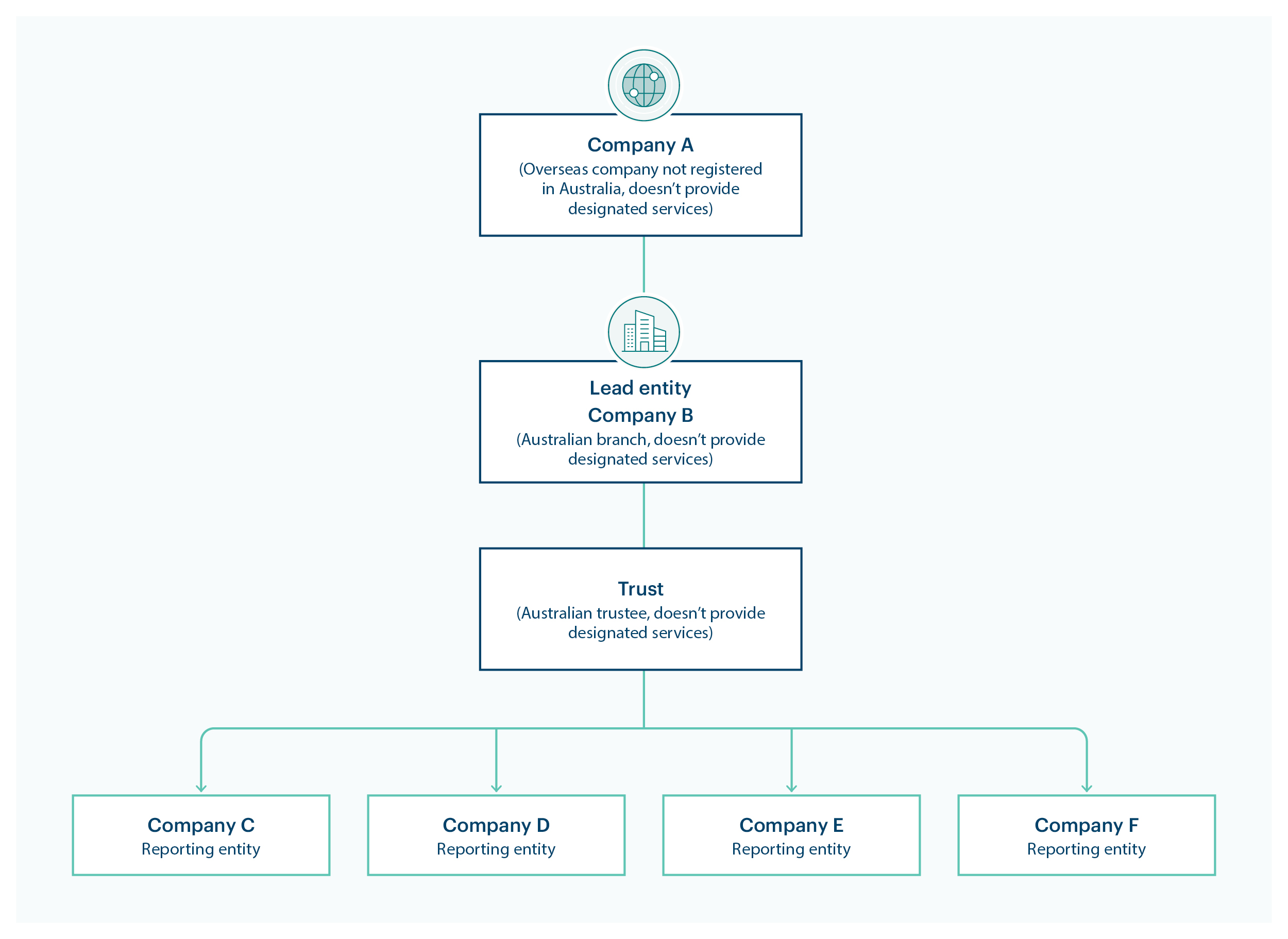

Example: Business group with foreign ownership

This example shows a reporting group with an overseas parent company at the top of the control structure (Company A) but with Company B as its lead entity.

Company A is incorporated in a foreign jurisdiction and hasn’t registered in Australia (within the meaning of the Corporations Act 2001). Company A has an Australian subsidiary, Company B (Australian branch).

Company B is an Australian incorporated person. Company B controls a trust with an Australian trustee and 4 companies. The 4 companies are all reporting entities.

Company A hasn’t registered in Australia so cannot be a lead entity, but will still form a part of the reporting group. This means it may:

- be involved in information sharing under the group AML/CTF program

- discharge AML/CTF obligations on behalf of reporting entity members.

In this scenario, each member agrees in writing that Company B will be the lead entity.

However, the members of the group could have agreed that the lead entity could be either:

- Company B

- the trust.

This is because both persons:

- are Australian-based members of the reporting group

- have the capacity to determine the outcome of decisions about the AML/CTF policies of the reporting entities of the group

- aren’t controlled by any of the reporting entities.

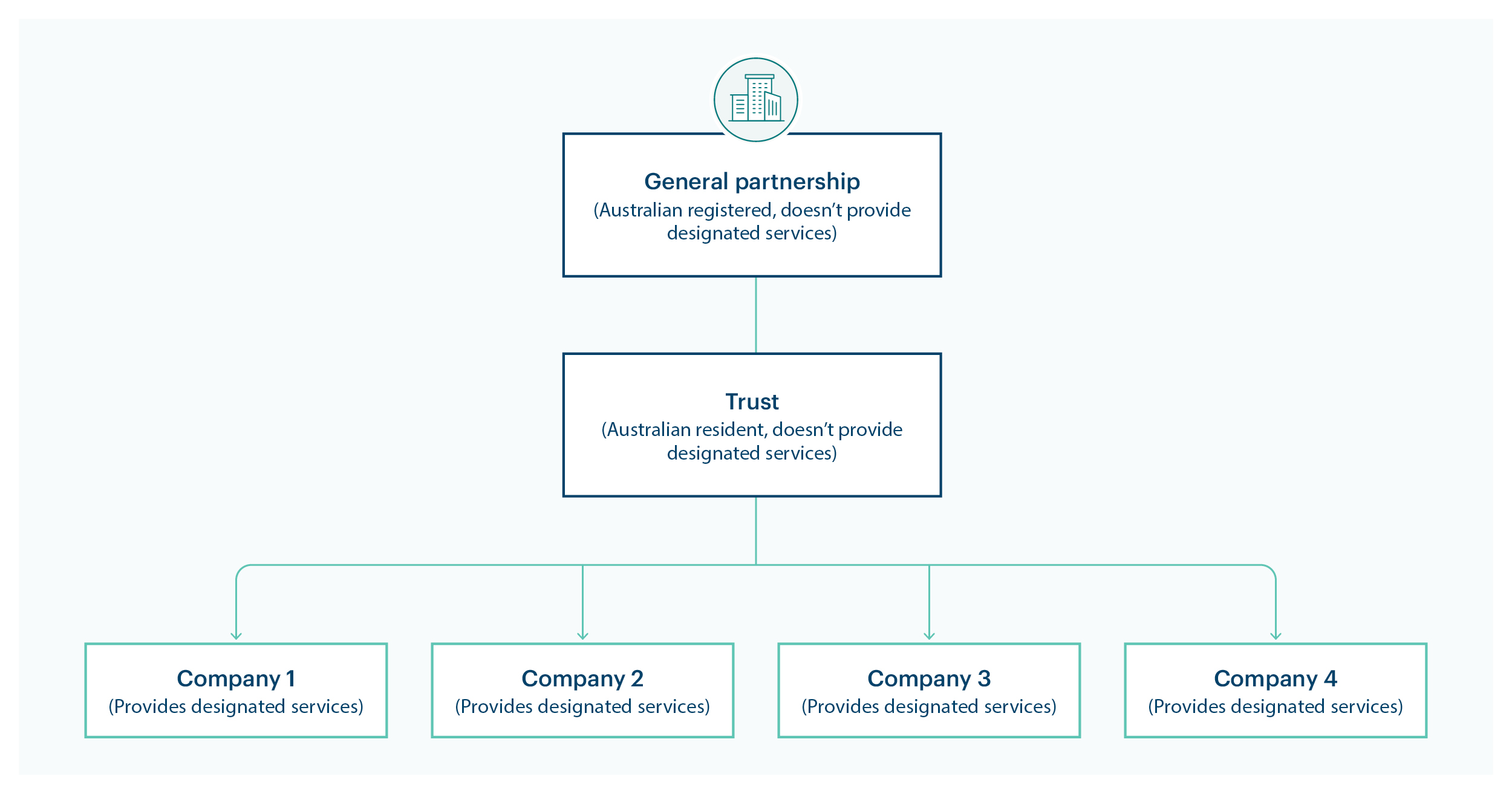

Example: Business group

This example shows the control structure of a general partnership and subsidiaries who met the requirements of a business group.

This group will become a reporting group because:

- each member agreed on a lead entity in writing

- the general partnership controls all other persons in the group and doesn’t provide designated services

- the trust controls the companies in the group

- the general partnership and trust are both Australian-based members

- companies 1, 2, 3, and 4 are the only reporting entities

- both the general partnership and trust meet the requirements to be lead entities.

The general partnership, and all entities under their control, can form a reporting group. Either the partnership or the trust can be the lead entity if each member agrees in writing.

Elective reporting groups

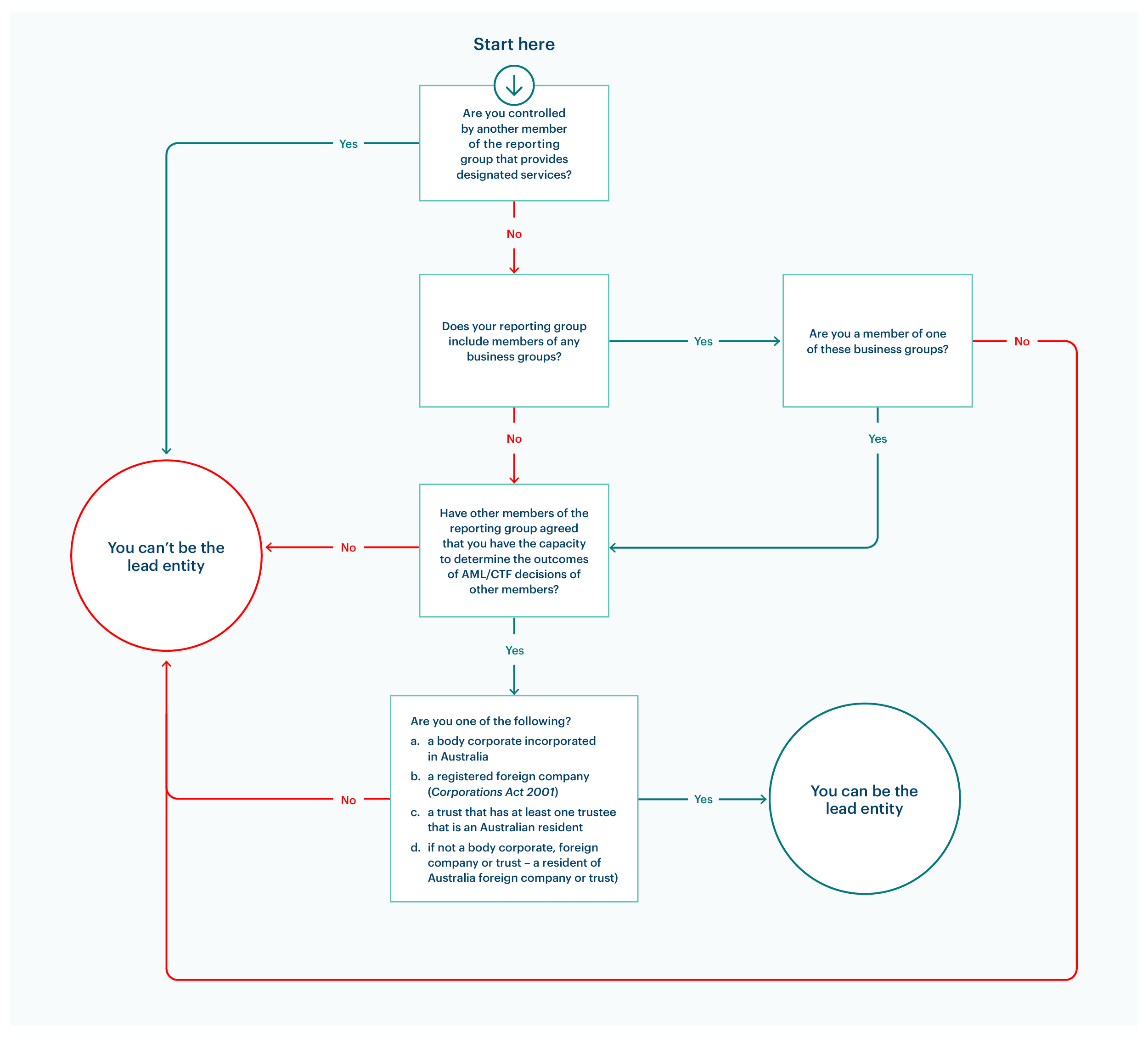

This section refers to the Rules section 2–2(3)(a–d).

If you’re forming an elective reporting group, each one of your members must agree on a lead entity. This includes the lead entity.

Your lead entity must be a person that meets the criteria below.

If you have members from one or more business groups, your lead entity must be from one of those groups.

How to determine the lead entity of an elective reporting group

The below flowchart will help you determine who can be the lead entity in your elective reporting group.

Your elective group can’t be without a lead entity. If your answers lead you to ‘the member can’t be the lead entity’, you must restart the process.

Can I be a lead entity?

Example: Forming an elective group

A real estate franchisor and their franchisees decide to come together to form an elective reporting group. This is because the franchise agreement between them doesn’t give the franchisor control over their franchisees.

The franchisor is an Australian body corporate with subsidiaries that aren’t reporting entities. The franchisor’s subsidiaries agree to join the elective reporting group.

The franchisor agrees to act as the lead entity of the group to help the franchisees with their AML/CTF obligations.

Each member in the group agrees in writing to form a reporting group. The group consists of:

- persons who aren’t members of any other elective group

- reporting entities

- non-reporting entities, that discharge obligations on behalf of reporting entities in the group.

All members:

- agree that the franchisor has the capacity to determine the outcome of their decisions about AML/CTF policies

- will be the lead entity

- elect the franchisor as lead entity within 28 days of forming the elective group.

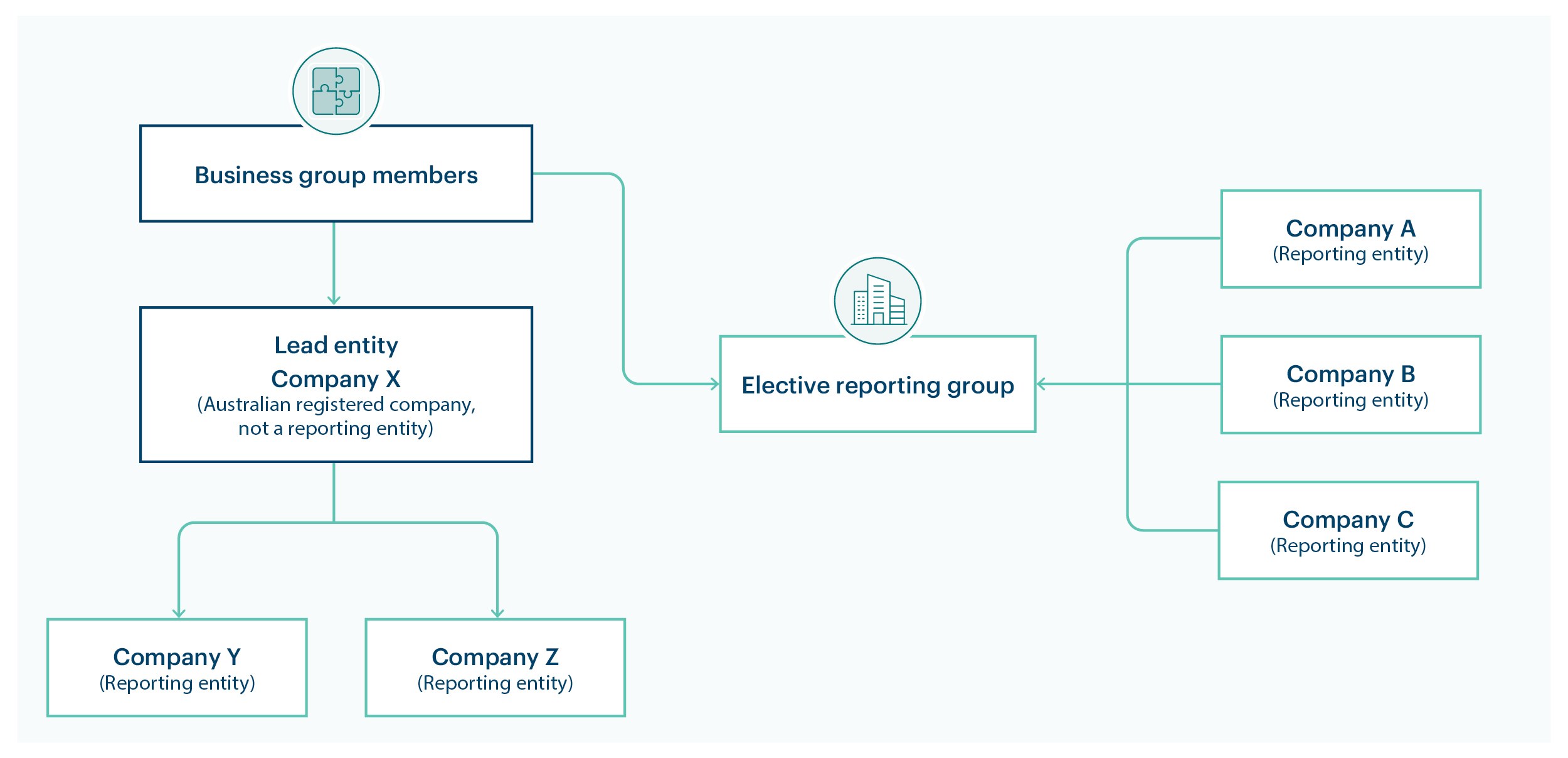

Example: Forming an elective reporting group with business group members

This example shows a scenario of a business group joining an elective reporting group with members outside its control structure:

- Company X, Y and Z are a part of the business group

- Company X controls Company Y and Z who are reporting entities

- Company X is an Australian-based member

- Company X elects in writing on behalf of Company Y and Z to form an elective group with Companies A, B and C

- Company Y and Z both agree.

Because this elective group has members of a business group within it, one of these business group members must be the lead entity.

All members (including Company X) agree in writing that Company X:

- will be the lead entity

- has the capacity to determine the outcome of decisions about the AML/CTF policies of the other members.

The elective group forms with members of a business group within it; Company A, B and C can’t be a lead entity. Company Y and Z also are not able to be a lead entity, as they do not have the capacity to determine the outcome of decisions about the AML/CTF policies of one another.

Lead entities leaving the reporting group

This section refers to the Rules sections 2–2(8) and (10)(a–b).

If you’re the lead entity of your elective reporting group, and want to leave the group, you can elect to do so. However, you must give each member of the group written notice.

The elective group must not operate without a lead entity for more than 28 days. Each member in your reporting group must agree on a new lead entity within this time.

The elective group must continue to comply with the AML/CTF policies of the previous lead entity.

Related pages

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.