Real estate program starter kit: Getting started

Learn what the real estate program starter kit is and how to get started customising an anti-money laundering and counter-terrorism financing (AML/CTF) program for your business.

On this page

- What the program starter kit is

- Before you start

- Why this change matters

- Who the starter kit is for

- What’s in the starter kit

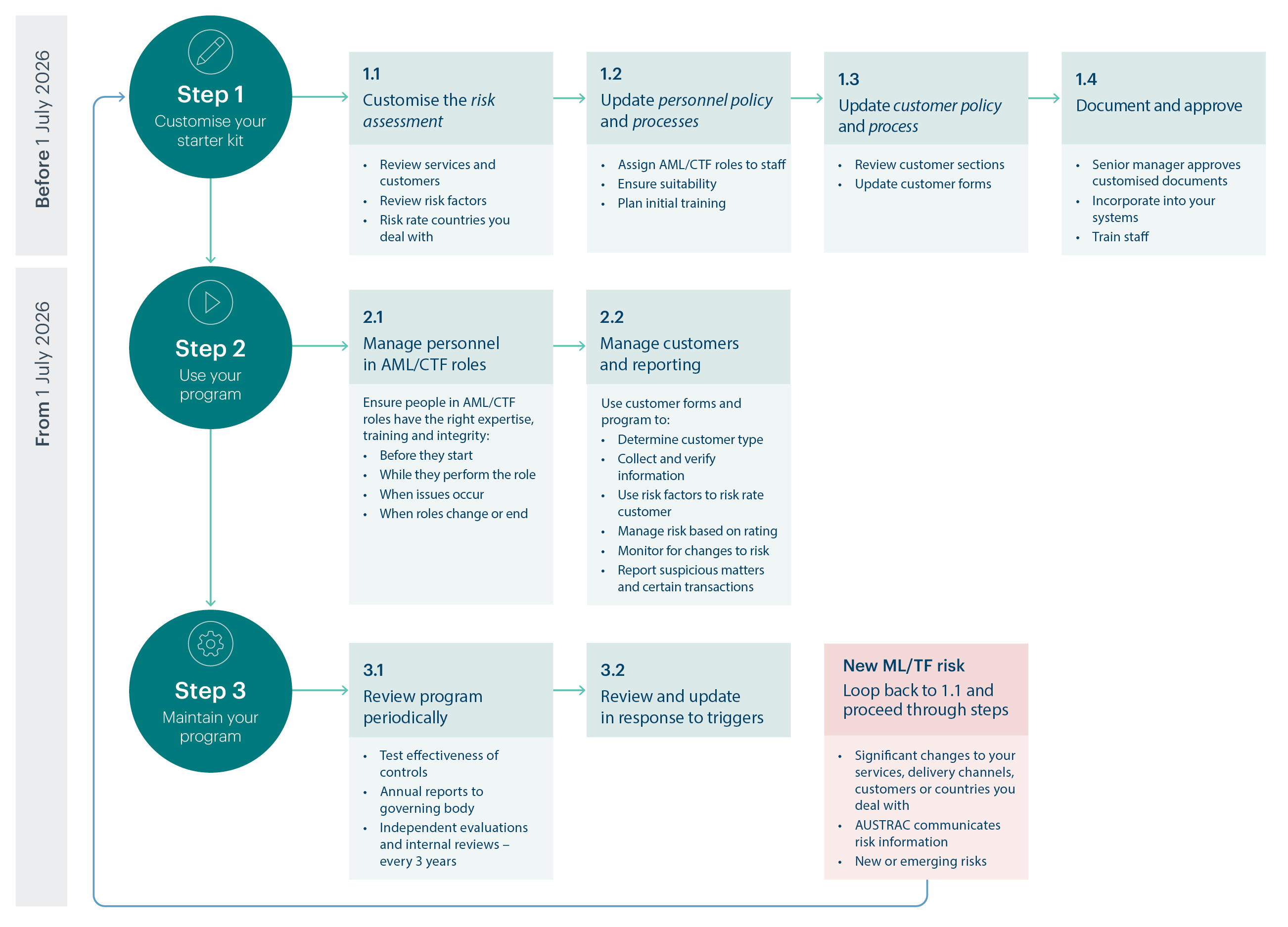

- Steps to use the starter kit

- Next step

What the program starter kit is

The real estate program starter kit (‘starter kit’) helps small real estate and buyer’s agencies customise, use and maintain an AML/CTF program.

From 1 July 2026, real estate and buyer’s agents must have an AML/CTF program in place before they broker the purchase, sale or transfer of real estate. This is known as providing a designated service.

Your business may already have measures in place that meet AML/CTF obligations, such as checks to identify your customers. The starter kit is designed to build on what you’re already doing. It provides a practical starting point to help you manage the money laundering, terrorism financing and proliferation financing risks your business may face. We refer to these as ML/TF risks.

Before you start

There are 2 steps you need to take before you start:

- Confirm you’re regulated by us.

- Get ready to enrol with us.

Why this change matters

Real estate is commonly used for money laundering in Australia. This is because property is valuable, tends to increase in value over time, and can generate income through rent or resale. Tax arrangements such as negative gearing can also make property attractive to criminals.

Your role is critical in identifying and responding to ML/TF risks. Having an effective AML/CTF program helps you:

- protect your business from being misused for financial crime

- meet your legal obligations

- make consistent, defensible decisions about customers and transactions.

Who the starter kit is for

The starter kit is designed for small real estate and buyer’s agencies that will be regulated under Australia’s AML/CTF laws.

The starter kit was designed for businesses with the following characteristics:

- Only provide one designated service: brokering the purchase, sale or transfer of real estate.

- Have 15 or less personnel working for the business. This includes all your personnel such as administrative staff as well as real estate agents.

- Most commonly deal with individual customers who are Australian residents, and less commonly with customers who are body corporates, legal arrangements or overseas residents.

- Don't regularly deal with high-risk customers.

- Don’t broker overseas property.

- Only handle customer funds directly related to real estate transactions.

- Don't provide fully remote self-service options that allow customers to obtain designated services from your business without interacting with your personnel.

- Don't sell property they own themselves (for example, property developers).

- Aren't acquiring all or part of another business and aren't transferring customers from another business (separate procedures apply, learn more about transitioning existing customers).

- Aren't part of a large reporting group, foreign branch or subsidiary.

If your business meets all these characteristics, the starter kit is suitable for you.

If your business doesn't meet all these characteristics

You must assess whether the starter kit is appropriate for your business and identify any changes you need to make.

You cannot rely on the starter kit to meet our regulatory expectations of an appropriate AML/CTF program for your business. You can consider whether parts of the starter kit may be adapted when developing your own AML/CTF program.

Large businesses are highly likely to face different and more complex ML/TF risks than those addressed by the starter kit. These will generally require stronger or additional controls.

Your AML/CTF program must reflect the size, nature and complexity of your business, and the risks it faces.

If you provide other services such as conveyancing or selling businesses

The real estate starter kit doesn’t include other designated services such as:

- conveyancing services

- assisting in the execution of a transaction to sell, buy or transfer a body corporate or legal arrangement.

If you provide other designated services, you must adapt your risk assessment and AML/CTF program to include them.

You may also want to consider the starter kits for conveyancers if you provide conveyancing services and starter kits for legal professions for buying or selling a body corporate or legal arrangement.

What’s in the starter kit

The starter kit provides a comprehensive AML/CTF framework aligned with Australian requirements. It includes:

- a risk assessment covering the common risks faced by your industry

- policies that outline what you must do and when

- processes that explain how AML/CTF tasks are carried out day-to-day

- forms to record information and demonstrate compliance.

Once customised to your business, these documents work together to form your AML/CTF program. You can then incorporate these documents into your existing systems and processes.

Steps to use the starter kit

Decide who will customise the program. This will usually be your AML/CTF compliance officer, who oversees day-to-day compliance. For real estate agencies, this will typically be your licensee in charge.

Start with Step 1: Customise your real estate program with the starter kit.

You’ll then be guided through each of the steps to customise the starter kit by 1 July 2026. Then from July, how to use and maintain your AML/CTF program:

Next step

The program starter kits are intended to be used as a complete package and have been designed for use by those reporting entities who satisfy certain suitability criteria. That suitability criteria is set out on this page under the heading “Who the starter kit is for” in each program starter kit. In particular, those Tranche 2 entities who, from 1 July 2026, are for the first time subject to anti-money laundering and counter-terrorism financing legislation (AML/CTF).

The program starter kits have been designed for the purpose of providing practical guidance to those reporting entities to assist them to build their own AML/CTF programs. The program starter kits represent AUSTRAC’s interpretation and application of the law to the eligible reporting entities only and are not intended to represent an interpretation and application of the law in all circumstances. The program starter kits are not a substitute for legal advice about any reporting entity’s AML/CTF compliance obligations. Australian courts are ultimately responsible for interpreting the AML/CTF legislation and determining if any provision of these laws are contravened.

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.