Conveyancing program starter kit: Getting started

Learn what the conveyancing program starter kit is and how to get started customising an anti-money laundering and counter-terrorism financing (AML/CTF) program for your practice.

On this page

- What the program starter kit is

- Before you start

- Why this change matters

- Who the starter kit is for

- What’s in the starter kit

- Steps to use the starter kit

- Next step

What the program starter kit is

The conveyancing program starter kit (‘starter kit’) helps small conveyancing practices customise, use and maintain an AML/CTF program.

From 1 July 2026, conveyancers must have an AML/CTF program in place before they assist in the planning or execution of a transaction to sell, buy or transfer real estate. This is known as providing a designated service.

Your practice may already have measures in place that meet AML/CTF obligations, such as checks to identify your clients. The starter kit is designed to build on what you’re already doing. It provides a practical starting point to help you manage the money laundering, terrorism financing and proliferation financing risks your practice may face. We refer to these as ML/TF risks.

Before you start

There are 2 steps you need to take before you start:

- Confirm you’re regulated by us.

- Get ready to enrol with us.

Why this change matters

Real estate is commonly used for money laundering in Australia. This is because property is valuable, tends to increase in value over time, and can generate income through rent or resale. Tax arrangements such as negative gearing can also make property attractive to criminals.

Your role is critical in identifying and responding to ML/TF risks. Having an effective AML/CTF program helps you:

- protect your practice from being misused for financial crime

- meet your legal obligations

- make consistent, defensible decisions about clients and transactions.

Who the starter kit is for

The starter kit is designed for small conveyancing practices that will be regulated under Australia’s AML/CTF laws. The starter kit is designed for practices with the following characteristics:

- Only provide one or both of the following designated services: assisting in the planning or execution of a transaction to sell, buy or transfer real estate or a body corporate or legal arrangement (learn more about these regulated services).

- Have 15 or less personnel working for the practice. This includes all your personnel such as administrative staff as well as conveyancers.

- Are not a practicing lawyer currently operating under a practicing certificate: legal practitioners who provide conveyancing services must use the legal practitioner program starter kit, which covers their ethical obligations and legal professional privilege)

- Most commonly deal with individual clients who are Australian residents, with clients who are body corporates, legal arrangements or overseas residents being less common.

- Don't regularly deal with high-risk clients.

- Don’t assist with the purchase, transfer or sale of overseas property.

- Only handle client funds directly related to real estate transactions.

- Don't provide fully remote self-service options that allow a client to obtain a designated service from your practice without interacting with your personnel.

- Don't sell property they own themselves (for example, property developers).

- Aren't acquiring all or part of another business, and aren’t transferring clients from another business (separate procedures apply, learn more about transitioning existing customers)

- Aren't part of a large reporting group, foreign branch or subsidiary.

If your practice meets all these characteristics, the starter kit is suitable for you.

If your practice doesn't meet all these characteristics

You must assess whether the starter kit is appropriate for your practice and identify any changes you need to make.

You cannot rely on the starter kit to meet AUSTRAC’s regulatory expectations of an appropriate AML/CTF program for your practice. You can consider whether parts of the starter kit may be adapted when developing your own AML/CTF program.

Large practices are highly likely to face different and more complex ML/TF risks than those addressed by the starter kit. These will generally require stronger or additional controls.

Your AML/CTF program must reflect the size, nature and complexity of your practice, and the risks it faces.

What’s in the starter kit

The starter kit provides a comprehensive AML/CTF framework aligned with Australian requirements. It includes:

- a risk assessment covering the common risks faced by your profession

- policies that outline what you must do and when

- processes that explain how AML/CTF tasks are carried out day to day

- forms to record information and demonstrate compliance.

Once customised to your practice, these documents work together to form your AML/CTF program. You can then incorporate these documents into your existing systems and processes.

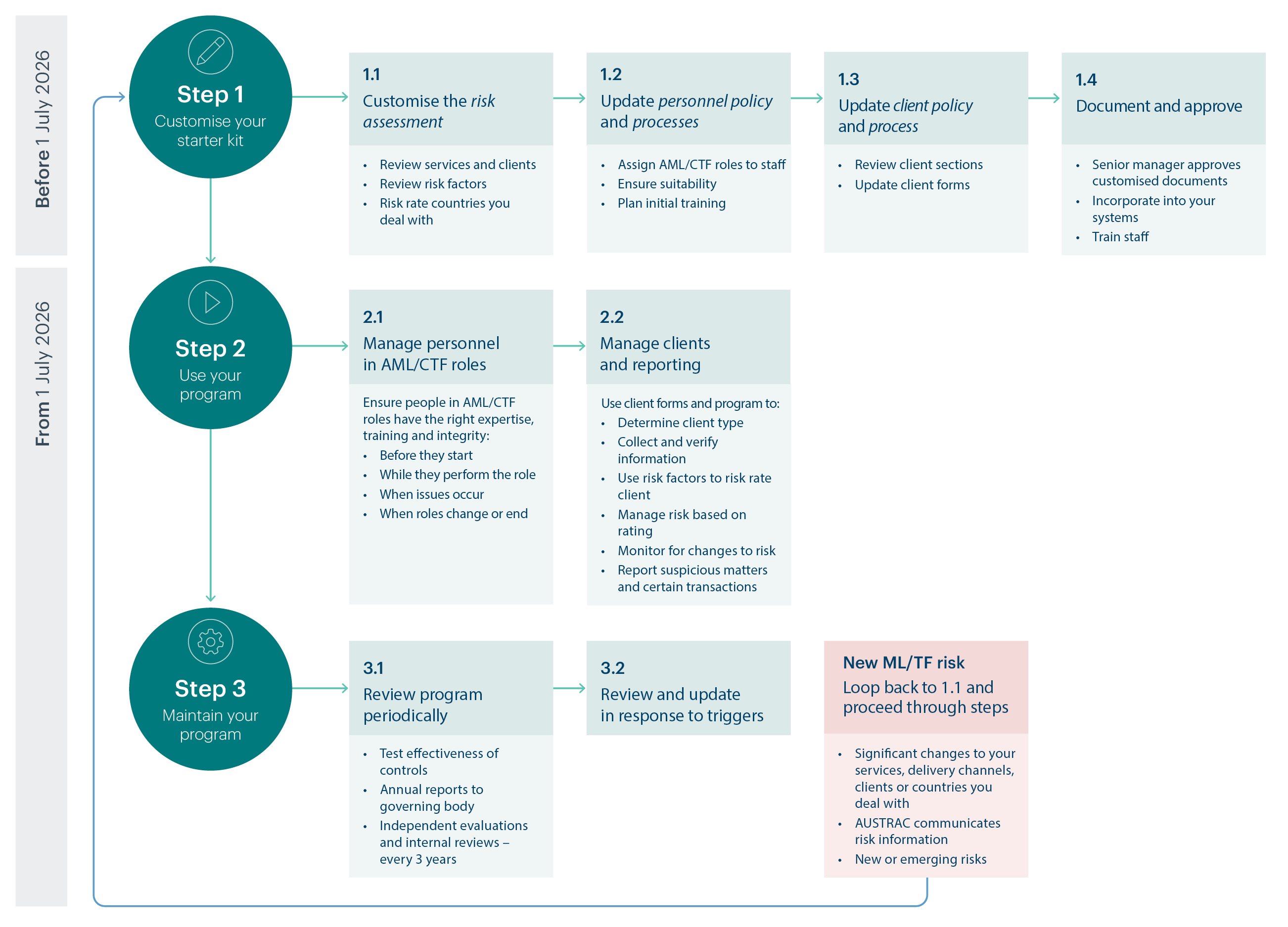

Steps to use the starter kit

Decide who will customise the program. This will usually be your AML/CTF compliance officer, who oversees day-to-day compliance. For conveyancers, this will typically be a senior conveyancer or your practice owner.

Start with Step 1: Customise your conveyancing program with the starter kit.

You’ll then be guided through each of the steps to customise the starter kit by 1 July 2026. Then from July, how to use and maintain your AML/CTF program:

Next step

The program starter kits are intended to be used as a complete package and have been designed for use by those reporting entities who satisfy certain suitability criteria. That suitability criteria is set out on this page under the heading “Who the starter kit is for” in each program starter kit. In particular, those Tranche 2 entities who, from 1 July 2026, are for the first time subject to anti-money laundering and counter-terrorism financing legislation (AML/CTF).

The program starter kits have been designed for the purpose of providing practical guidance to those reporting entities to assist them to build their own AML/CTF programs. The program starter kits represent AUSTRAC’s interpretation and application of the law to the eligible reporting entities only and are not intended to represent an interpretation and application of the law in all circumstances. The program starter kits are not a substitute for legal advice about any reporting entity’s AML/CTF compliance obligations. Australian courts are ultimately responsible for interpreting the AML/CTF legislation and determining if any provision of these laws are contravened.

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.