Determining ownership and control structures (Reform)

Learn about ownership and control to help you identify:

- who the beneficial owners of your customers are for initial customer due diligence

- if you’re in a business group

- who the lead entity of your business or elective reporting group could be.

On this page

- Terms we use on this page

- Beneficial ownership

- Control

- Determining ownership and control

- Beneficial ownership examples

- Business group examples

Terms we use on this page

Where we use the word person throughout this guidance, this includes any of the following:

- an individual

- a company

- a trust

- a partnership

- a corporation sole

- a body politic (including a government body)

- an unincorporated association.

The term customer in this guidance refers to customers who are a person (as referred to above) other than an individual.

Beneficial ownership

This section refers to the Act section 5.

A beneficial owner of a customer means an individual who directly or indirectly does any of the following:

- owns 25% or more of the customer

- controls the customer.

Ownership can be either:

- direct, such as through shareholding

- indirect, such as through another company’s ownership structure, or through an intermediary like a bank or broker.

When determining this beneficial ownership, there may be a chain of owners. This could include other persons who control or own 25% or more of your customer. You must follow this chain of ownership until you can determine the individual(s) who are the beneficial owner(s) of the customer.

Control

This section refers to the Act section 11.

Control refers to a person’s ability to influence or direct the decision-making process of another person. Control can be either:

- formal and direct, through ownership and voting rights

- through practical influence and established patterns of behaviour.

You don’t need to own another person to have control.

Control of a body corporate

This section refers to the Act section 11(1)(a-d).

A person ‘controls’ a body corporate (such as a company) if any of the following apply:

- Voting power – the person has the capacity to cast, or control the casting of, more than 50% of votes at a general meeting.

- Shareholding – the person directly or indirectly holds more than 50% of issued share capital (excluding shares that carry no right to participate beyond distribution of profits or capital, or mutual capital instruments).

- Board control – the person can control the composition of the board or governing body.

- Practical influence – the person can determine the outcome of decisions about financial and operational policies, considering any practical influence (rather than rights to be enforced) and practice or pattern of behaviour that affects those policies.

Control of a person other than a body corporate

This section refers to the Act section 11(2)(a-b).

Assessing the control of a person who isn’t a company (such as a partnership, trust or individual) is based on:

- Board control – the person can control the composition of any governing body (such as trustees, managers and committee).

- Practical influence – the person can determine the outcome of decisions about financial and operational policies, considering any practical influence (rather than rights to be enforced) and pattern of behaviour.

Determining ownership and control

This section refers to the Act section 28.

Customers may have complex ownership structures, and their beneficial owners can be difficult to identify. You must know how your customer is owned, controlled and managed.

Usually, you can ask the customer for the information you need. However, you may need to do your own research.

Documents that can help you with your research include:

- information on ASIC registers

- annual statements including the amendments submitted to ASIC

- current and historical company extracts from ASIC.

Other documents that can help include:

- the company’s constitution and/or memoranda

- trust deeds

- partnership agreements

- constitutions of registered cooperatives

- distribution statements to shareholders.

Public professional registers, such as the Financial Advisers Register, can also help. You can use these to check companies’ association with a professional, such as a financial adviser.

You may also choose to engage with third party services. These services may be able to provide you with beneficial ownership information at a cost.

Beneficial ownership examples

Read our examples of beneficial ownership.

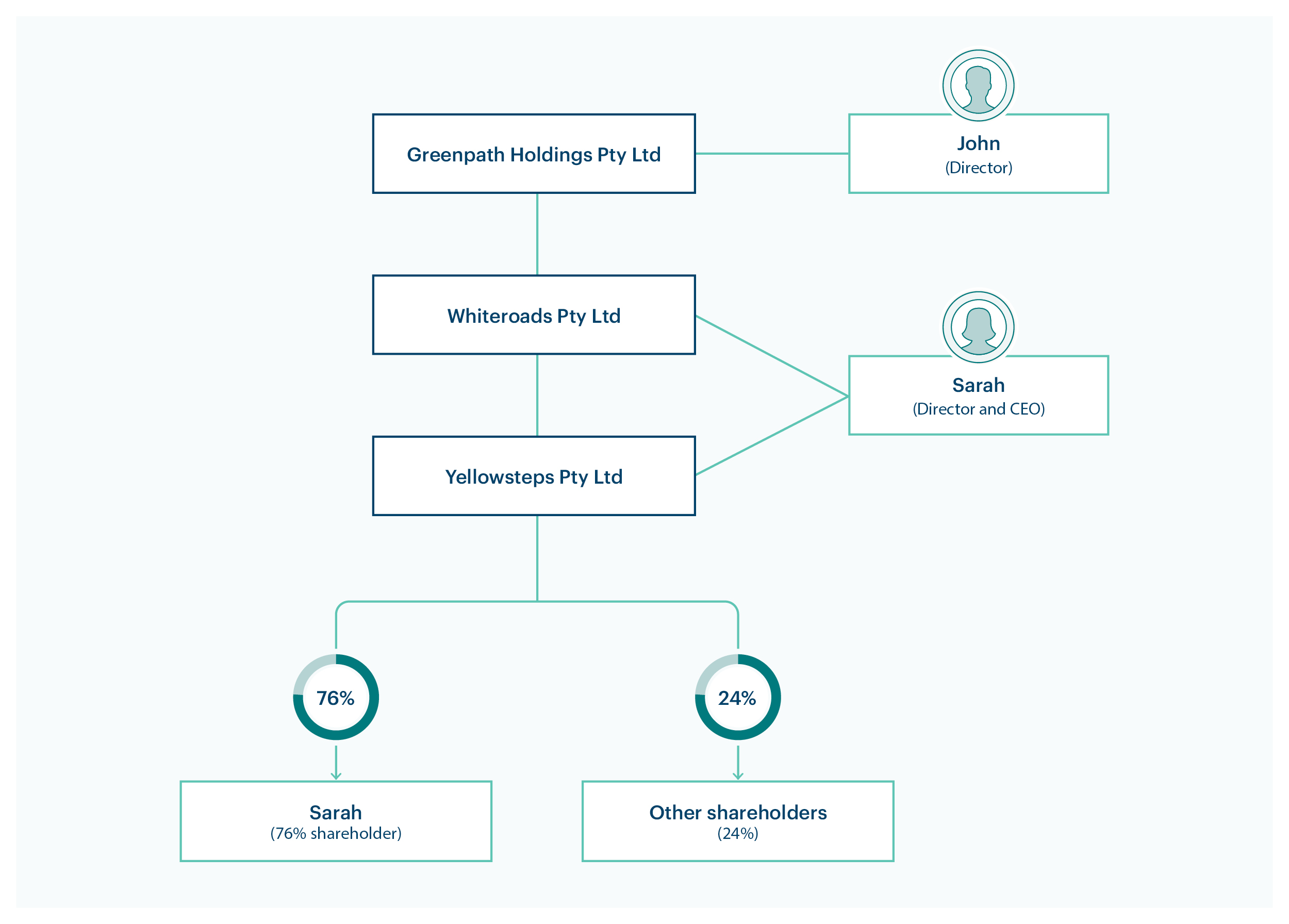

Example: determining beneficial ownership of a company

Summerset Bank is a mid-sized financial institution. John is the sole director of Greenpath Holdings Pty Ltd. He attends a branch in person to apply for a business transaction account for the company.

The bank begins initial CDD on Greenpath Holdings Pty Ltd as the customer. They identify John as the authorised agent to act on behalf of the customer as its sole director.

As part of their initial CDD process, the bank requests identification documents from John. They also request documents to show the company’s corporate and ownership structure. John submits documents with this information.

The bank begins reviewing the company documents to identify the beneficial ownership and organisational structure. They notice that Whiteroads Pty Ltd is its sole shareholder.

Summerset does a more in-depth search by getting current and historic ASIC searches of both:

- Greenpath Holdings Pty Ltd

- Whiteroads Pty Ltd.

The ASIC search identifies that a third company, Yellowsteps Pty Ltd, owns Whiteroads Pty Ltd.

Summerset does further ASIC checks and uncovers that Sarah:

- owns 76% of Yellowsteps Pty Ltd

- acts as the sole director and thus assumed to be a key decision maker of Yellowsteps Pty Ltd and Whiteroads Pty Ltd.

No other individual owns 25% or more of Yellowsteps Pty Ltd.

Summerset has established that Sarah ultimately owns Greenpath Holdings Pty Ltd. Summerset submits a request for further information from John, explaining they need to verify Sarah’s identity as well.

John gives Sarah’s phone number and Summerset asks her to provide documents to verify her identity. Sarah goes to a branch of the bank and brings her driver’s licence and a utility bill in her name.

Summerset verifies the identity information using the document verification system (DVS). They find no differences in the information Sarah provided. Summerset checks if Sarah is:

- a politically exposed person

- subject to sanctions

- linked to any high-risk jurisdiction lists.

Their search results in no matches.

Because of their findings, Summerset assigns a medium risk rating for Greenpath Pty Ltd. This is due to the legal ownership structure and is in line with their ML/TF risk assessment. They open the account.

The bank then uploads all documents to the customer file. This includes the ownership path and all 3 company extracts.

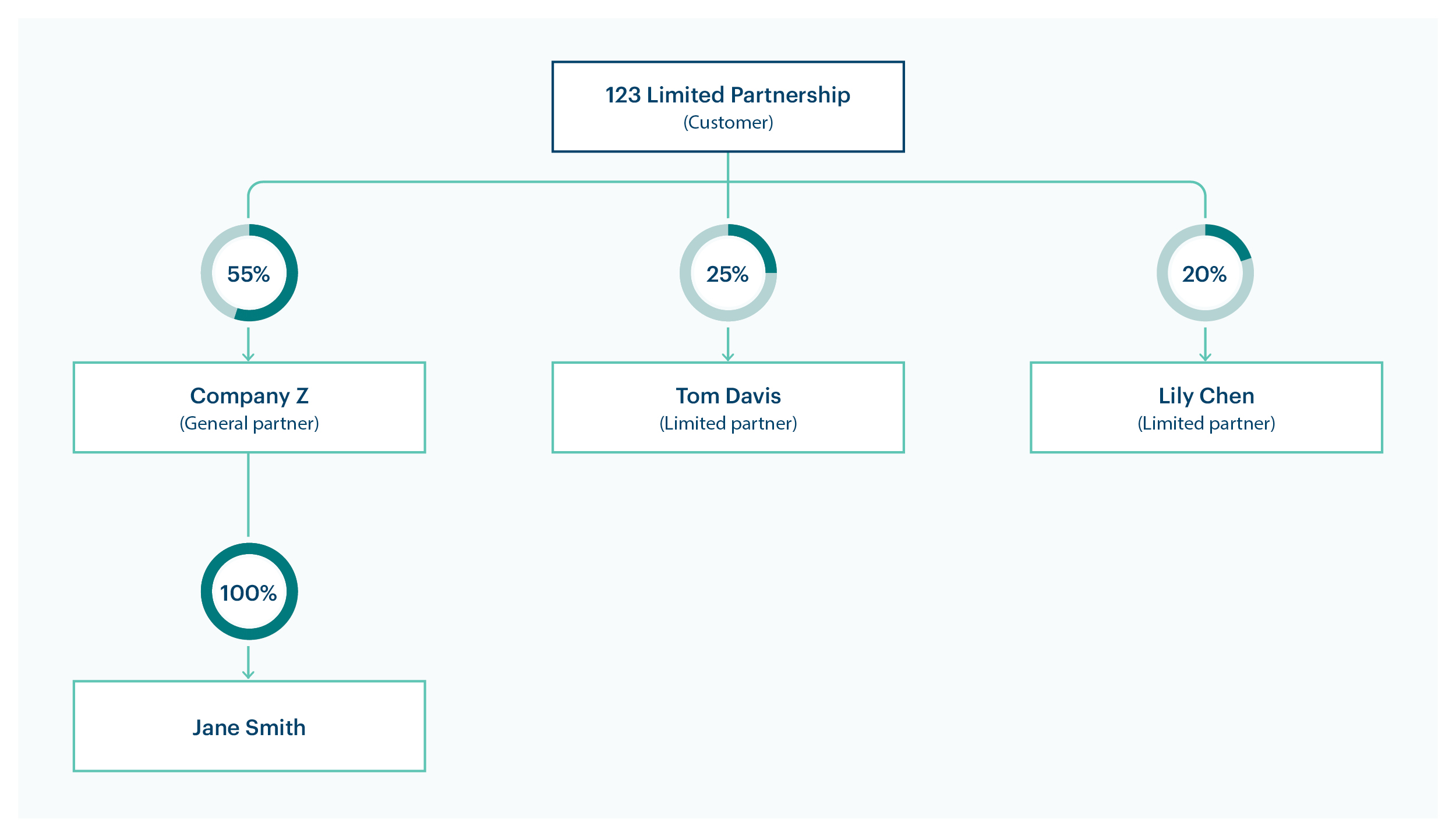

Example: determining beneficial ownership of a limited partnership

A law firm is trying to identify the beneficial owner of their prospective customer, 123 Limited Partnership. They’ve asked to view the partnership agreement.

Based on 123 Limited Partnership’s partnership agreement:

- They have one general partner (Company Z) and 2 limited partners. Tom Davis who holds 25% of the capital, Lily Chen who owns 20% of the capital and they both have profit entitlement but no voting rights.

- Company Z is the general partner. It holds 55% of the capital, profit entitlement and holds all voting rights in 123 Limited Partnership.

- Company Z isn’t acting as a nominee general partner.

- Jane Smith is the sole shareholder of Company Z.

Tom Davis is a beneficial owner based on his 25% ownership in the limited partnership.

Jane Smith is a beneficial owner based on her ownership of Company Z, which controls the limited partnership.

Business group examples

This section refers to the Act sections 10A(1)(a) and (3) and the Rules sections 2–1(1), (2) and (2)(a).

A business group forms when all the following apply:

- one person controls one or more persons

- at least one of the persons provides a designated service.

The members of the business group will then be all persons within the control structure.

You can form a reporting group that's a business group if all members of your business group agree in writing on a lead entity.

Your lead entity can be any member of the business group that is all of the following:

- not controlled by any member of the business group that provides designated services

- has the capacity to determine the outcome of decisions about the AML/CTF policies of the other members

- is a body corporate, resident or a registered foreign company in Australia or a trust with at least one trustee that's a resident in Australia.

Learn more about forming reporting groups.

The following examples help identify members of the reporting group and lead entities.

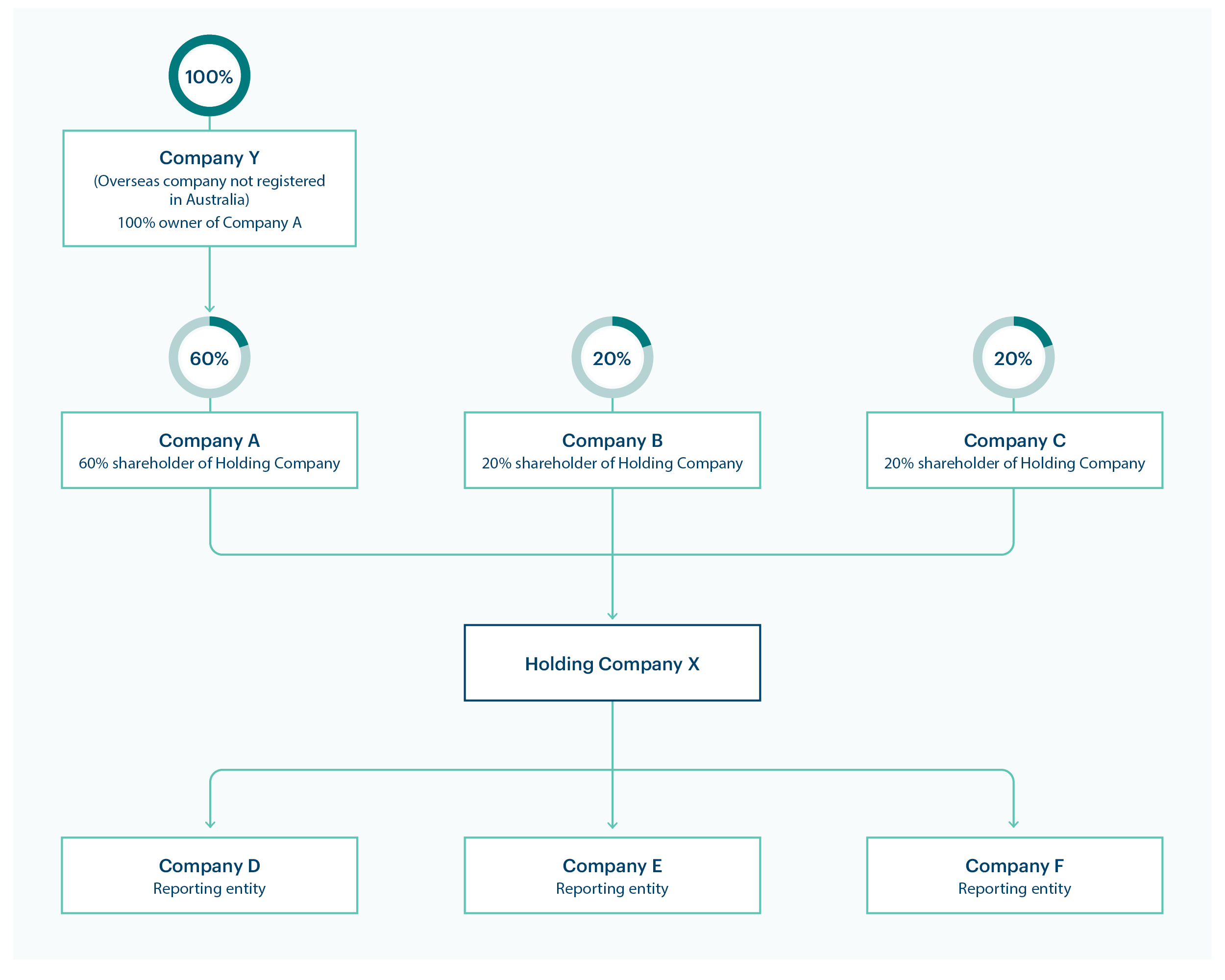

Example: shareholder control

All of the companies above are incorporated in Australia except for Company Y, which is a foreign company not registered in Australia and doesn't provide designated services.

3 reporting entities (Company D, Company E and Company F) are trying to identify:

- if they are in a business group

- if so, if they can form a reporting group by electing a lead entity in this business group.

Who are the members of the business group

They break the business structure down in the following way:

- Company A is the majority shareholder of Holding Company. Therefore, it controls Holding Company and reporting entities Companies D, E and F.

- Holding Company is the sole shareholder of Companies D, E and F. Therefore, Holding Company controls these reporting entities.

- Company Y is the sole shareholder of Company A. Therefore, it controls Company A, Holding Company and reporting entities Companies D, E and F.

Company Y, Company A, Holding Company, Companies D, E and F are within the control structure and are therefore all members of the business group.

Companies B and C are minority shareholders of Holding Company. As they own less than 50% of the shares, they don’t control it or the reporting entities Companies D, E and F, so aren't members of the business group.

Who can be a lead entity

Company A and Holding Company could be lead entities, as they are:

- incorporated in Australia

- not controlled by Companies D, E and F – other members of the business group that provide designated services

- have the capacity to determine the outcomes of decisions about the AML/CTF policies of Companies D, E and F, as they control these reporting entities.

Company Y cannot be a lead entity, as it isn't a resident body corporate or registered foreign company in Australia or a trust with at least one trustee that's a resident in Australia.

They can form a reporting group if all the members of the business group (Company Y, Company A, Holding Company, Companies D, E and F) agree on Company A or the Holding Company being the lead entity in writing.

If formed, the members of the reporting group would be Company Y, Company A, Holding Company, Companies D, E and F.

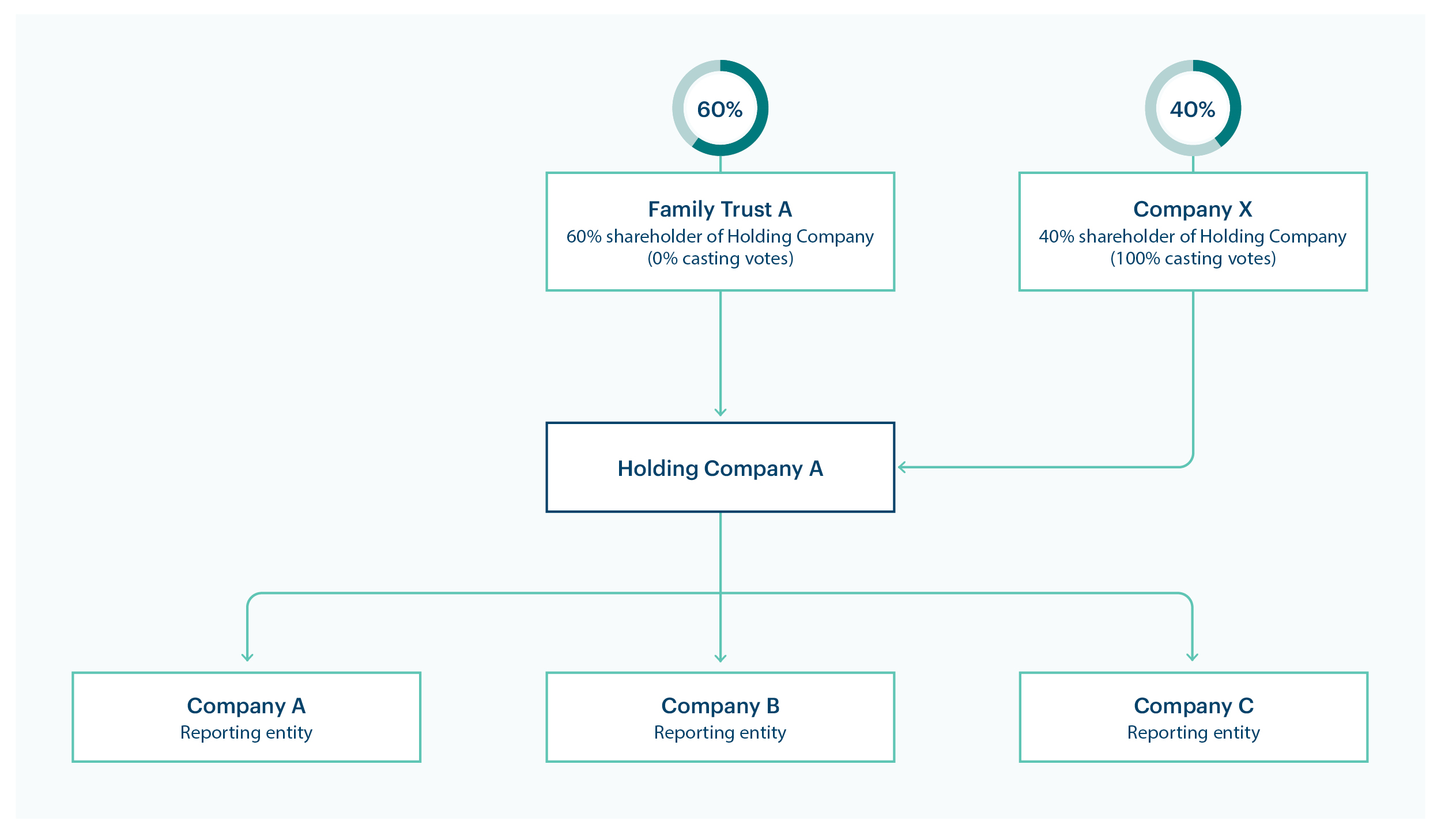

Example: voting power control

All of the companies above are incorporated in Australia.

The above group are deciding if they’re a business group that can form a reporting group. They’re also trying to determine who the lead entity is.

Who are the members of the business group

They break down their structure in the following way:

- Company X controls Holding Company A, as while they have only 40% of the shares, they can cast 100% of votes at a general meeting.

- Holding Company A is the sole shareholder of Companies A, B and C. Therefore, Holding Company A has control of these reporting entities.

Company X, Holding Company, Companies D, E and F are within the control structure and are therefore all members of the business group.

Although Family Trust A is a majority shareholder of Holding Company A (and therefore owns this Company), they have no control and aren't in the business group, because:

- they don’t have any casting votes

- they can’t control the board

- they can’t make decisions about the financial and operating policies

- their share capital gives them no right to participate beyond distributions of profit or capital.

Who can be a lead entity of a reporting group

Company X and Holding Company A could be lead entities, as they are:

- incorporated in Australia

- not controlled by Companies D, E and F – other members of the business group that provide designated services

- have the capacity to determine the outcomes of decisions about the AML/CTF policies of Companies D, E and F, as they control these reporting entities.

All members will have to agree in writing on who will be the lead entity. This includes Company X, Holding Company, Companies D, E and F.

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.