QRG: How to update your details

You must keep your enrolment and account details up to date. You must tell us about any changes to your enrolment details within 14 days.

On this page

Updates you need to make

You need to update any changes to:

- the services you provide

- the structure of your business or organisation. This includes if your business merges with another reporting entity

- your contact details

- the names and contact details of key personnel, such as directors or officeholders

- your annual earnings.

Learn more about updating your annual earnings.

Updating your details

To update your details:

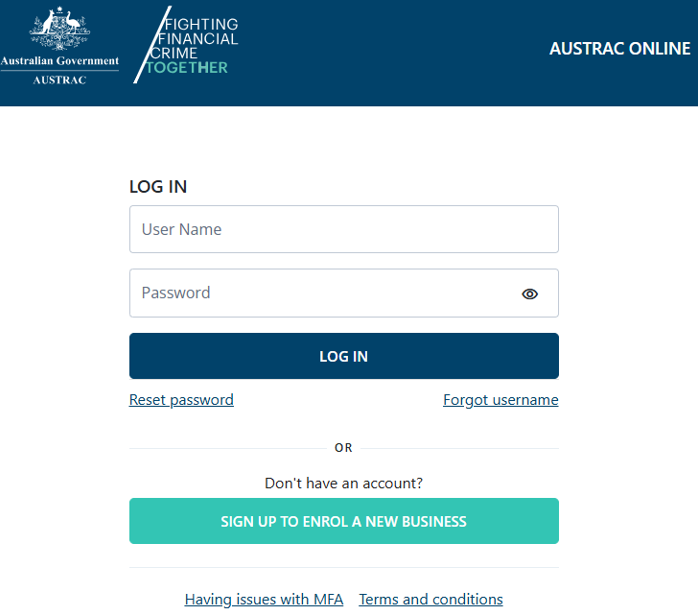

- Go to AUSTRAC Online.

- Log in with your username and password.

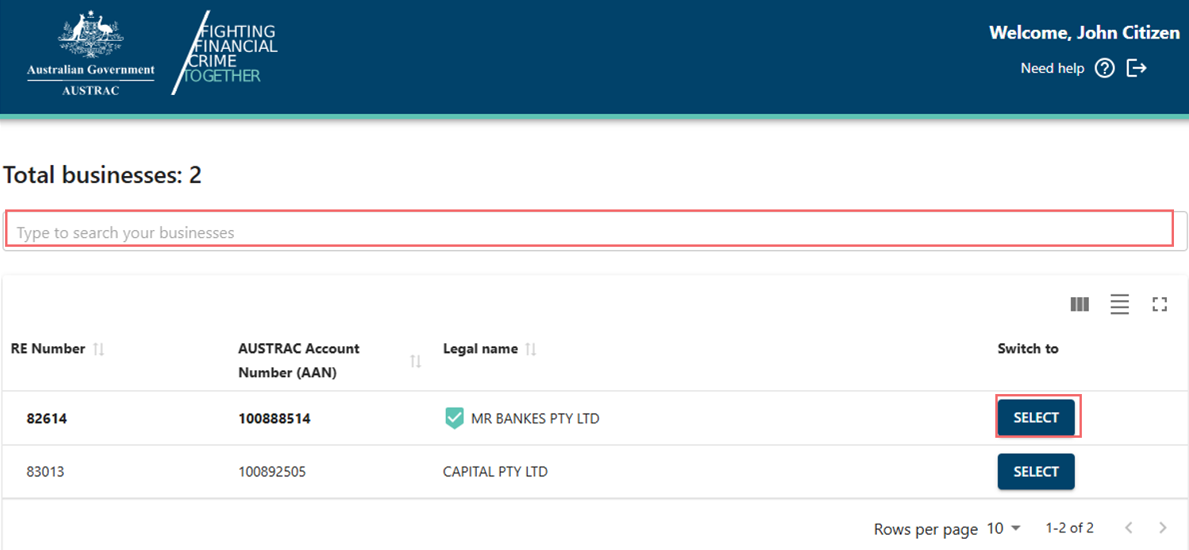

- If you’re a user for more than one reporting entity the screen below will appear. There’s a search function available.

- Select the business you want to update.

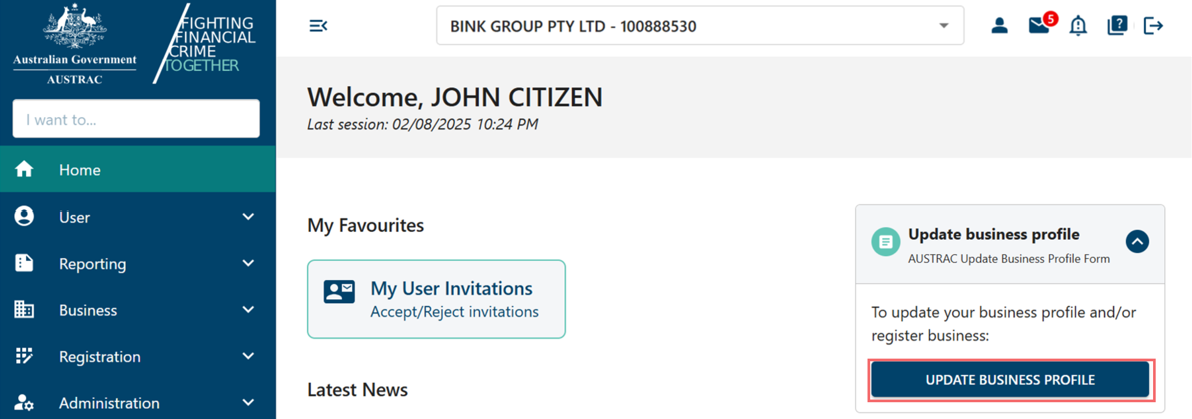

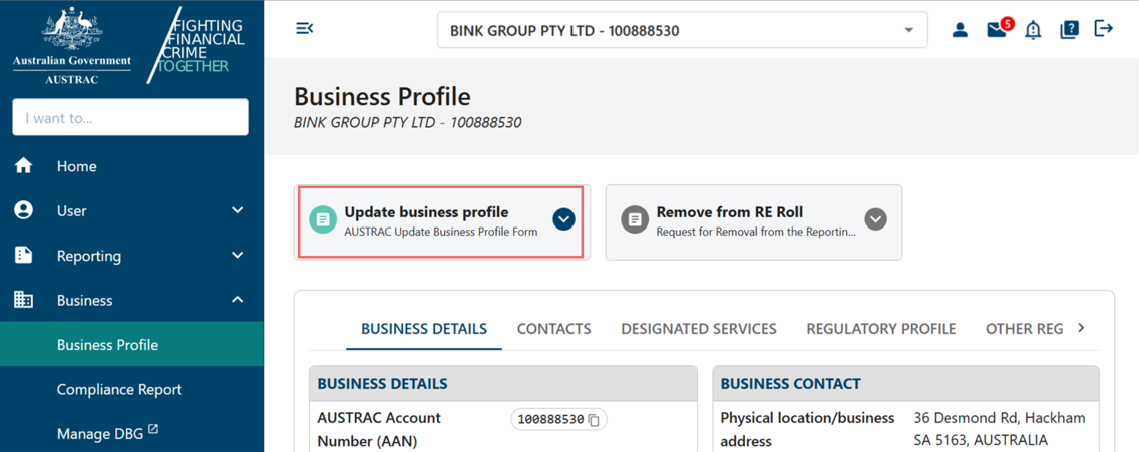

- There are 3 ways to access the Update Business Profile Form in AUSTRAC Online:

- On the right-hand side of the home page.

- By selecting Business Profile in the Business menu.

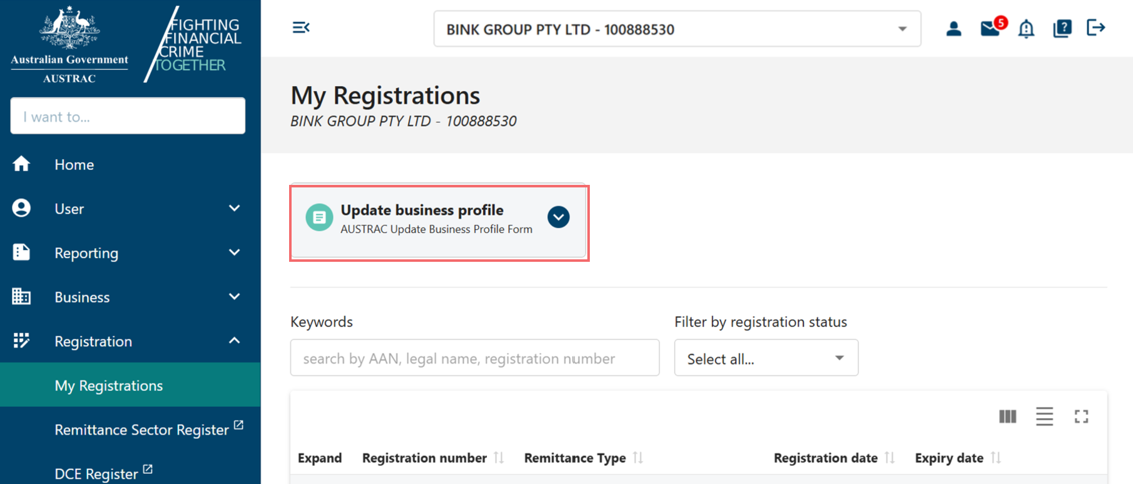

- By selecting My Registrations in the Registration menu.

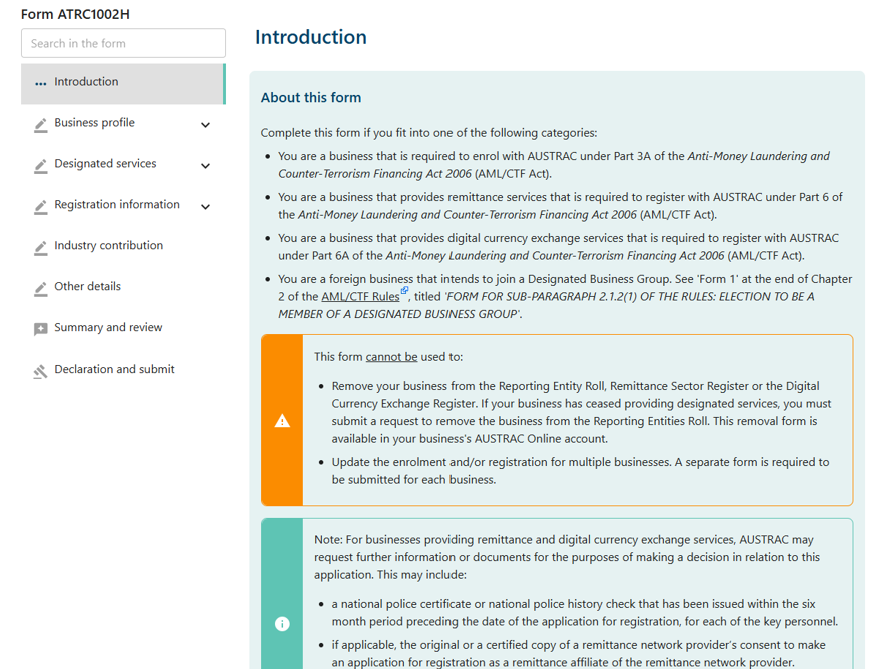

- Complete the sections on the form you want to update.

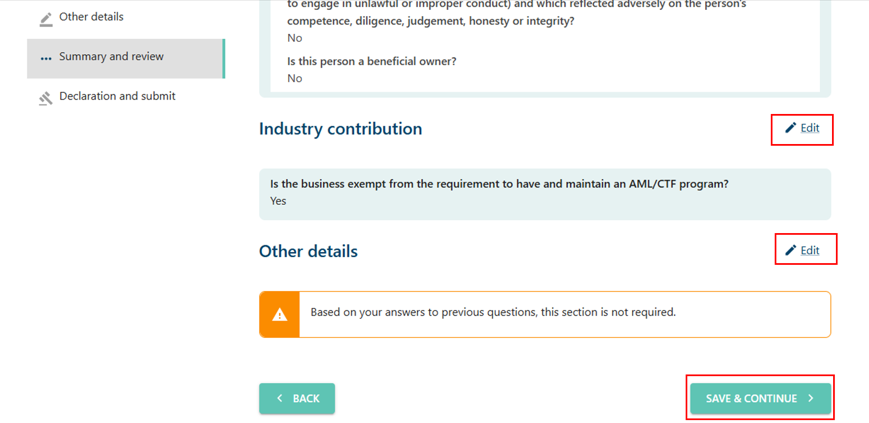

- When you reach the summary and review section, review everything that you entered in the previous sections.

- Select the Edit buttons to make any changes.

- Select Save and continue.

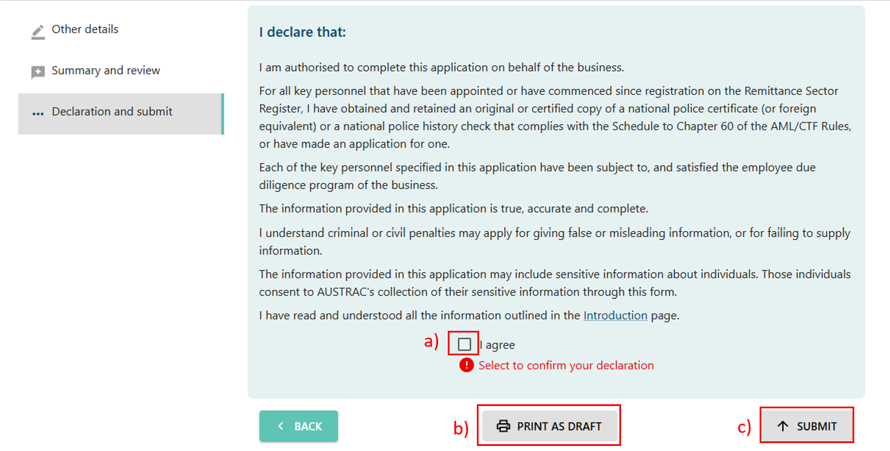

- On the declaration page:

- Check the I agree box to agree to the declaration.

- Print or save a copy of your form using Print as draft (after checking I agree).

- Select Submit when you’re ready to submit your form (after checking I agree).

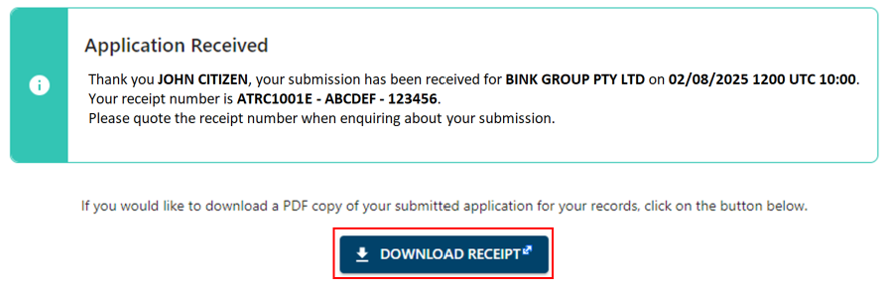

- The confirmation page includes your receipt number. You can quote this for any enquiries about your submission form.

- Select Download receipt to save a copy of your submitted form for your records.

- You’ll get a submission confirmation email from contact@austrac.gov.au. It will contain your receipt number, submission date and time, and a link to download your submitted form.

- Switch back to the browser tab to continue with other tasks or log out.

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.