QRG: How to register a business

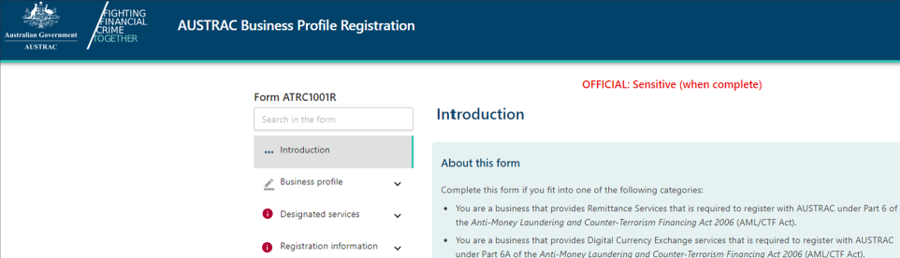

If you provide a remittance or digital currency exchange service, you must register with us. Find out how to register after you’ve enrolled with us.

On this page

This page will show you how to register your business after enrolment. If you haven’t already enrolled, go to our how to enrol a business guide.

Details you need

Have the following details to help you fill out the form quickly:

- DCE foreign registrations (if applicable)

- remittance foreign registrations (if applicable)

- associated entities

- serious offences of your business

- key persons

- affiliate registrations (if applicable).

Registering a business

To register a business:

- Go to AUSTRAC Online.

- Log in with your username and password.

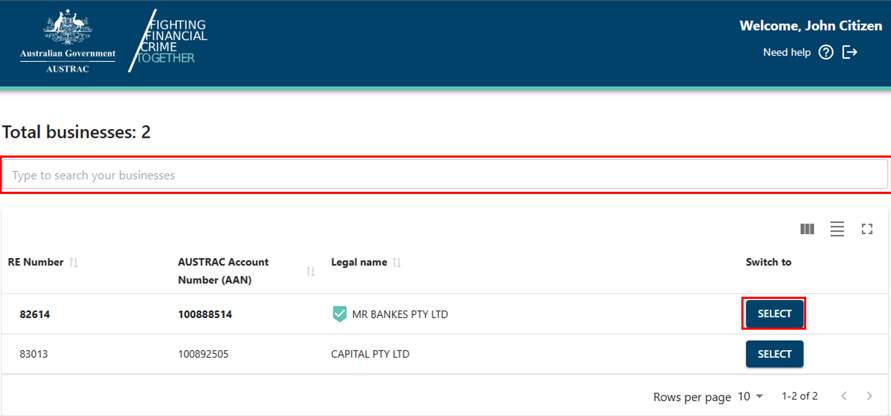

- There’s a search function available. Select the business you want to register.

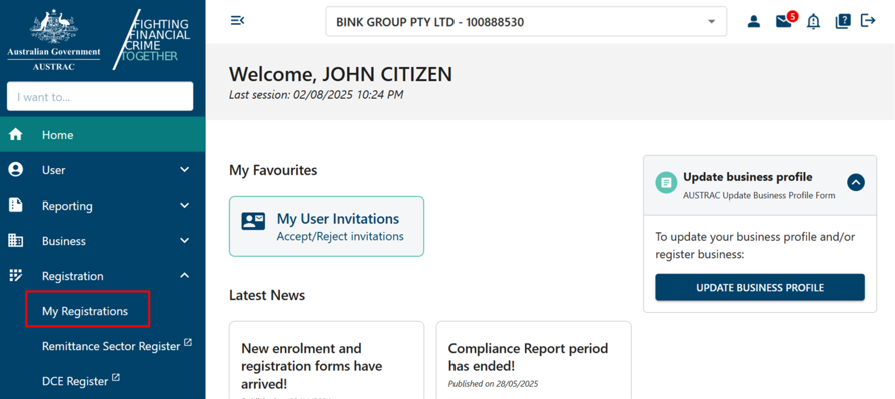

- Go to My Registrations in the Registrations menu to open a display of your registration information.

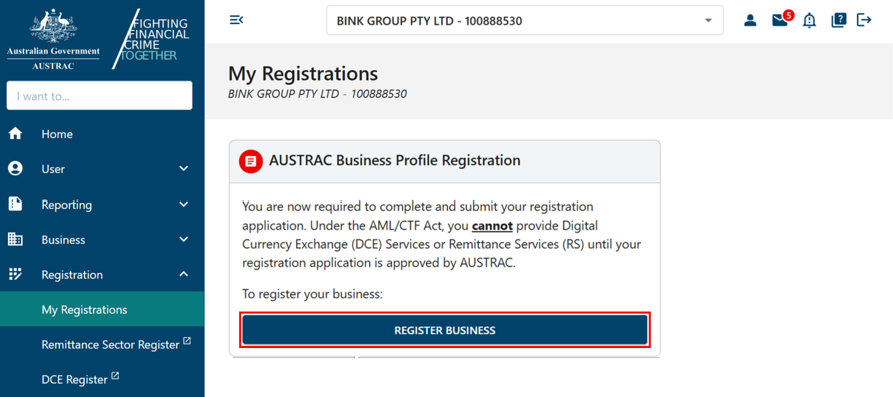

- Select Register business.

- Complete all sections on the form.

Note: any sections that are incomplete will have a red icon.

Your enrolment details will be prepopulated in the registration form. If they’re not correct, you’ll need to complete an Update business profile form (1002H) to update any details. You can also complete your registration using this form.

Learn how to update your details.

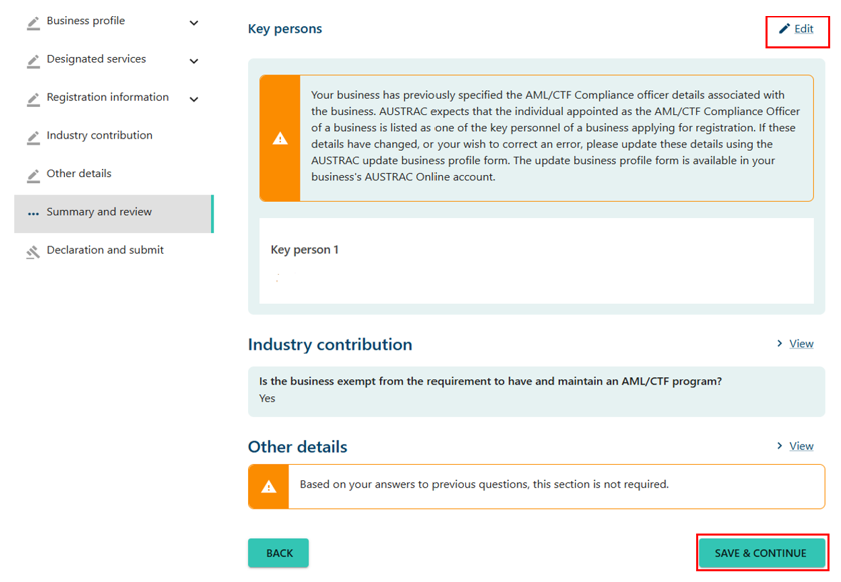

- When you reach the summary and review section, review everything that you entered in the previous sections.

- Select the Edit buttons to make any changes.

- Select Save and continue.

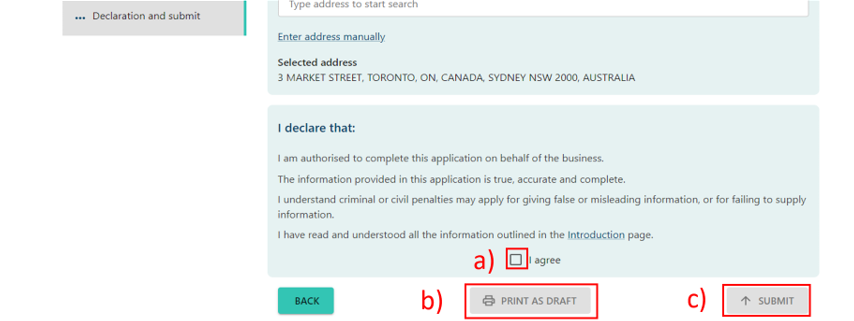

- On the declaration page:

- Check the I agree box to agree with the declaration.

- Print or save a copy of your form using Print as draft (after checking I agree).

- Select Submit when you’re ready to submit your form (after checking I agree).

- The confirmation page includes your receipt number. You can quote this for any enquiries about your application.

- Select Download receipt to save a copy of your submitted form for your records.

- You’ll get a submission confirmation email from contact@austrac.gov.au. It will contain your receipt number, submission date and time, and the link to download your submitted form.

- Switch back to the browser tab to continue with other tasks or log out.

This guidance sets out how we interpret the Act, along with associated Rules and regulations. Australian courts are ultimately responsible for interpreting these laws and determining if any provisions of these laws are contravened.

The examples and scenarios in this guidance are meant to help explain our interpretation of these laws. They’re not exhaustive or meant to cover every possible scenario.

This guidance provides general information and isn't a substitute for legal advice. This guidance avoids legal language wherever possible and it might include generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases your particular circumstances must be taken into account when determining how the law applies to you.